Sat-Sun: Non-working days

Within the scope of this brief article, it is not possible to fully and deeply analyze the state of the Earth remote sensing data market. Therefore, without claiming to possess the ultimate truth, the author would like to outline some key trends that seem important.

Over the past decade, we have witnessed the realization of the "vision of the future" from the early 2000s, when the second civilian satellite with sub-meter spatial resolution, QuickBird, was launched into orbit after IKONOS. Discussions about the "truthfulness" of the two-and-a-half-meter resolution of the planned SPOT-5 satellite were ongoing, while current and highly successful sales of current images from domestic analog cameras KFA-1000 and MK-4 were taking place. Today, that "future" is becoming a reality and even commonplace - geoportals such as Google Earth or Yandex Maps, frequent high-resolution imaging of all major cities and almost all smaller ones, radar images with meter resolution, and much more.

The global, and along with it, the Russian remote sensing data market is becoming increasingly saturated. Today, current data from a dozen commercial satellites with meter and sub-meter resolution are available, and the archive of one of them - OrbView-3 - is freely accessible online. In the next 10 years, hundreds of new remote sensing satellites are expected to be launched, which will benefit both current consumers of this data and those who are not yet (although their numbers are decreasing). The increase in the number of data sources is one of the reasons for qualitative changes in the market - such as the long-term trend of decreasing costs for "raw" optical/near-IR data across almost all spatial resolutions, or the delivery of products that best match customer needs (from selecting data types and processing levels to post-processing and possible end-user training), as well as suppliers' focus on derivative products rather than just "selling pixels."

Additionally, due to more frequent imaging of the same urban or inter-settlement area by high- and super-high-resolution systems over the past decade, and the formation of an impressive archive of satellite images with comparable characteristics, it is now possible to conduct monitoring with higher frequency and more qualitative retrospective analysis. This is enabled by the ability to compare data from the same sensor, for example, Ikonos images from 2000 and 2011.

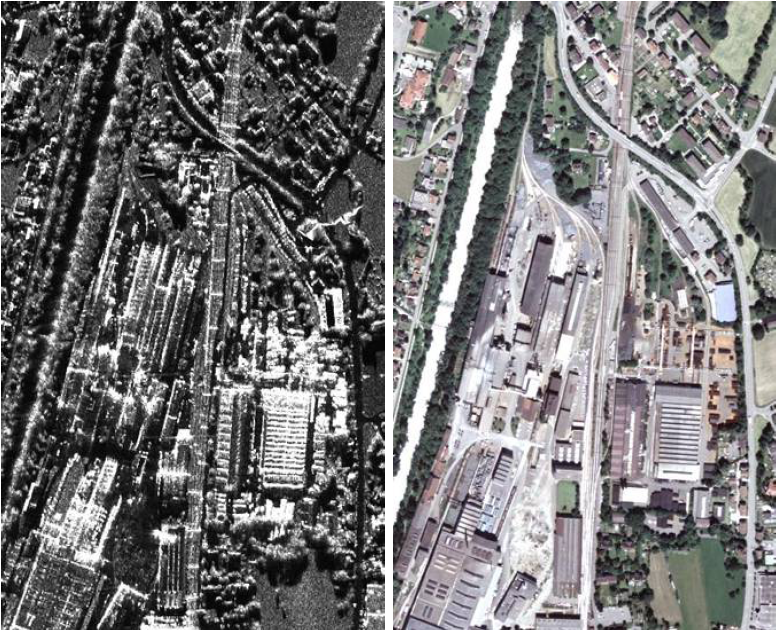

Comparison of radar image and aerial photography © Infoterra GmbH

Another trend that began, if not with the appearance of the hyperspectral Hyperion in 2000, whose 220 spectral bands were interesting, though not always successfully interpreted, then with WorldView-2, which is positioned specifically as a satellite with unique additional spectral ranges, particularly in the visible spectrum. In its two and a half years of operation, the eight-channel data has been used in several commercial applications (precision agriculture, bathymetry, etc.). However, the full potential of this data is far from being fully realized, hence the annual competition for the best original application of eight-channel data attracts many participants, including from Russia.

In the next 2-3 years, a plethora of sensors awaits us, both with additional spectral channels and hyperspectral ones: LDCM (Landsat-8) and Resurs-P in 2013, Sentinel-2 and WorldView-3 in 2014, ALOS-3 in 2015. Therefore, the emergence of new types of data, new methodologies, and new derivative products in the near future seems inevitable.

Another emerging trend is the increase in the number of small remote sensing satellites. Already, constellations like RapidEye (Germany), DMC (UK, Spain, China, Nigeria), and individual satellites belonging to Ukraine, Turkey, Malaysia, UAE are deployed. The launch of the domestic "Kanopus-V" and Belarusian BKA satellites is expected this summer. Small satellites are attractive primarily due to reduced development timelines and launch risks, as well as their relatively low cost. For consumers, the advantage lies in a wider choice of affordable sources of high and medium spatial resolution images with additional "bonuses" such as daily imaging by RapidEye or a 300 or 660-kilometer swath capture by NigeriaSat-2 and UK-DMC2, respectively.

NigeriaSat-2, fragment of image, resolution 2.5m

The radar data market is currently experiencing a real boom, which began with the launch of systems such as TerraSAR, COSMO-SkyMed, and Radarsat-2. Products with unique characteristics previously only available to the military are emerging, and radar satellite imaging can be performed regardless of cloud cover or time of day. Thus, meter spatial resolution significantly enhances the informativeness of radar data, approaching optical data, although simultaneous imaging in different polarization modes does not equate radar and optical data, especially in the eyes of inexperienced users. On the other hand (partly due to data supplier activity), there is a widespread understanding of new radar products, and now a wide range of users, together with suppliers, must learn to apply radar images not only for "classic" tasks (monitoring oil spills or ice conditions) but also for tasks such as identifying types of agricultural crops or deciphering artificial objects (railway infrastructure, ports, etc.).

Small satellite "Kanopus-V"

Unlike optical range images (WorldView, GeoEye, etc.), meter-range radar images are still relatively expensive, and there is room for improvement. New impetus to the radar image market is expected from data from inexpensive satellites like NovaSAR-S, whose launch is planned for next year and which will be capable of obtaining 6-meter S-band images in three polarization modes. Additionally, unusual products are already available, such as the global mosaic PALSAR, created from L-band radar data on the ALOS satellite (available in 10 and 25-meter resolutions), which is particularly suitable for identifying vegetated areas.

The digital elevation and terrain models (DEM and DTM) market, which began to actively develop with the entry of SPOT IMAGE into it by the mid-2000s (now part of EADS ASTRIUM) with its 20-meter SPOT DEM model, is soon expected to see a new trend - the introduction of terrain models based on TerraSAR satellite data. The global 12-meter model, expected in 2014, aims to set new standards of quality and performance, for example, in accurately aligning high-resolution optical images, tasks related to terrain modeling, geological surveys, etc., albeit as a paid service.

Geoportals and geoservices have been actively developing since the mid-2000s, including in our country. Here, remote sensing data serves both as a "base layer" and as a foundation for thematic layers after decryption. Portals like Roscosmos and Rosreestr, as well as regional geoportals, confirm the demand for spatial data infrastructure at the federal and regional levels, which in turn guarantees the demand for high-quality Earth remote sensing data in the domestic market in the future.

It is also necessary to mention the organizational aspect of the market, namely the interaction between private business and the state. Today, examples of such cooperation are gaining popularity worldwide. For instance, satellite families like EROS and SPOT, TerraSAR-X, RADARSAT-2 are developed with private capital. In Russia, Innoter is involved in the calibration of "Kanopus-V" cameras, in shaping the final products, and in satellite image processing technology.

In conclusion, it is hoped that the aspects of the Earth remote sensing data market covered in this article, as well as those not addressed, will receive more detailed consideration in future issues.

Yuriy L. Koytsan, Dr. Sci. (Eng.), Professor, Director of the Faculty of Space Research, Moscow State University of Geodesy and Cartography (MIIGAiK), Moscow, Russia. March 2013.