Sat-Sun: Non-working days

Introduction

An overview of foreign military reconnaissance, surveillance, and reconnaissance (monitoring) satellites is primarily characterized by the achieved strategic and tactical goals of the geospatial intelligence system. This pertains to the system as a whole, not individual components of armed forces, in both peaceful and conflict scenarios in various regions of the world and the implementation of technology on the actual battlefield. Understanding modern warfare involves striking the enemy while minimizing harm to one's own soldiers.

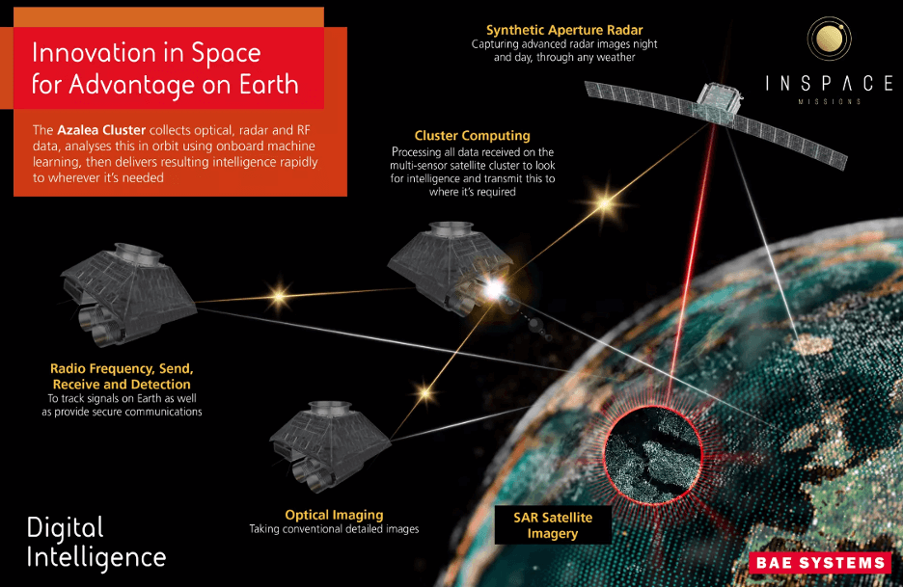

ISR (Intelligence, Surveillance, and Reconnaissance) - is the coordinated and integrated acquisition, processing, and timely provision of accurate, up-to-date, consistent, and guaranteed information and intelligence data to support commander's actions. Ground, maritime, aerial, and space platforms (hardware + software) play a crucial role in supporting operations. ISR is the raw source for a larger geospatial intelligence task - Geospatial Intelligence (GEOINT), which is a leading component of global intelligence in terms of both tasks and costs.

In this review, we focus exclusively on the satellite level of the state and development of ISR in the United States, NATO countries (United Kingdom, France, Germany, Italy), China, India, Israel, Turkey, Japan, South Korea, and Luxembourg.

The objective, in these conditions, and the concept of future global warfare, direct the satellite component to solve the task of using precision weapons based on detailed geospatial information, its analytical solutions, and the temporal factor of defeating the enemy while causing maximum damage.

At the beginning, we present conclusions on the technical characteristics of satellite ISR without analytics.

The stated positions are crucial primarily for understanding the aspirations of global scientists and engineers, intelligence organizations of the mentioned countries, reflecting the degree of development of the industry (especially sensor industry) in geospatial intelligence in a specific area - military ISR satellites.

Key conclusions on trends in the technical characteristics of military satellite groups for Earth Remote Sensing (ERS):

· Panoramic optical mode allows for spatial resolution of 15 cm per pixel (CCD matrix 40,000 x 40,000 pixels, mirror diameter from 2.5 meters).

· Multispectral mode at 50 cm per pixel, including near-infrared (IR) and thermal IR with a resolution of 5-7 meters per pixel.

· Radar imaging at 15-25 cm per pixel (X-band), expanding the capabilities of radar satellites (SAT) in the C, L, S, P bands.

· Ultraviolet, hyperspectral, and microwave sensors on board SAT.

· Gravimetric studies to create a reference up to 1 cm for ISR.

· Spectral patterns for decrypting enemy equipment, weapons, and fighters on the tactical battlefield.

· Mobile tracking of military equipment with georeferencing for precision strikes.

· Automatic on-board processing and transmission of reconnaissance information within 15 minutes in the battlefield.

· Integration of satellite, aviation, and UAV information in an integrated processing system, a unified domain of control.

· Transmission of satellite geospatial information through closed (encrypted) communication channels without compressing geospatial information.

· High-precision detection of nuclear radiation in the environment (foliage, soil, water, trees, plants).

· Programming of each pixel of the image.

The scientific spectrum of military ISR satellite development and support (communication, weather, experimentation, etc.) is very broad and requires a separate analysis.

It should be clear that the military ISR satellite group is complemented by commercial devices (up to 70%) and involves technological exchange, where commercial advancements often outpace military ones in terms of implementation speed.

Thus, the global space-based C4ISR market was estimated at USD 2.76 billion in 2021. According to forecasts, by 2030, it will reach USD 4.12 billion, increasing by 4.8% during the forecast period (2022-2030). These estimates do not account for classified and "black" military programs.

C4ISR - stands for Command, Control, Communications, Computers (C4) and Intelligence, Surveillance, and Reconnaissance (ISR). Advanced C4ISR capabilities enhance situational awareness, familiarize with the enemy and the environment, and reduce the time between detection and response. Key market stimulators include an increase in global defense spending, advancements in electronic warfare technologies, and the development of new technologies to enhance C4ISR military capabilities.

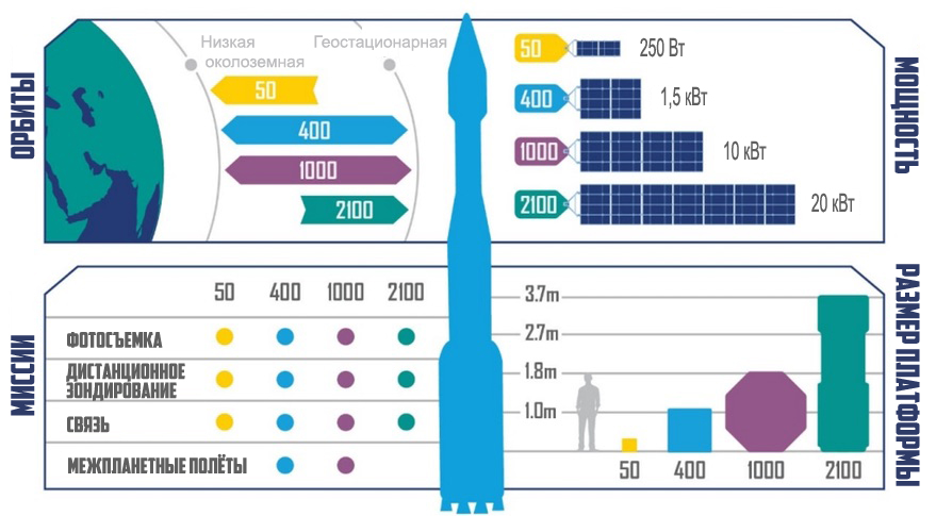

Simultaneously, there is a shift towards small satellites or significant reduction in the weight characteristics of SAT, even in the direction of strategic ISR satellites (e.g., from 11 tons to 1.9 tons). This is a stable trend in microelectronics development.

The review does not address ISR SAT for evaluating data on satellites in orbit and its "pollution," military planetary and deep space reconnaissance.

Undoubtedly, the missile component also plays a significant role in ISR satellite programs. There are contradictions and problems in this area.

U.S. Military ISR Satellites

The key potential of reconnaissance that allows the U.S. armed forces to maintain their superiority lies in the means of space, aviation, and UAV reconnaissance, observation, and reconnaissance (ISR). Committees on Armed Services of the House of Representatives and the Senate show increasing interest in the capabilities of the U.S. armed forces in ISR concerning China and Russia. The technological and operational superiority of the U.S. is constantly questioned due to shifting alliances and the growing capabilities of potential adversaries. ISR systems come in different sizes, sensor qualities, platforms, and software, from mobile devices to satellites. ISR systems extract information from unstructured data and analyze it. This data is used to facilitate the transmission of information, geospatial information in real-time in modern combat conditions, allowing soldiers on the battlefield to make more effective decisions.

"ISR capabilities are crucial for the Department of Defense (DOD) attempts to position U.S. and allied forces to outsmart, outpace, and outmaneuver their adversaries. For faster data exchange, they intend to connect ISR sensors from all areas of combat, including space, sea, air, land, and cyber, directly to command and weapon systems" - Chairman of the Joint Chiefs of Staff of the U.S. Military, November 2022, report to the U.S. Senate Select Committee on Intelligence.

The problem today is that the U.S. Department of Defense is overwhelmed by the exponential growth of ISR data from numerous sources but recognizes a significant potential for extracting valuable intelligence from various data sources. The question is: what useful information to extract and how to transmit it quickly?

The U.S. Department of Defense aims to shift from labor-intensive forces optimized for operations in favorable conditions to automated and "artificial intelligence" (AI)-equipped units capable of defeating equal adversaries in contested situations to meet the requirements of the new global strategic context.

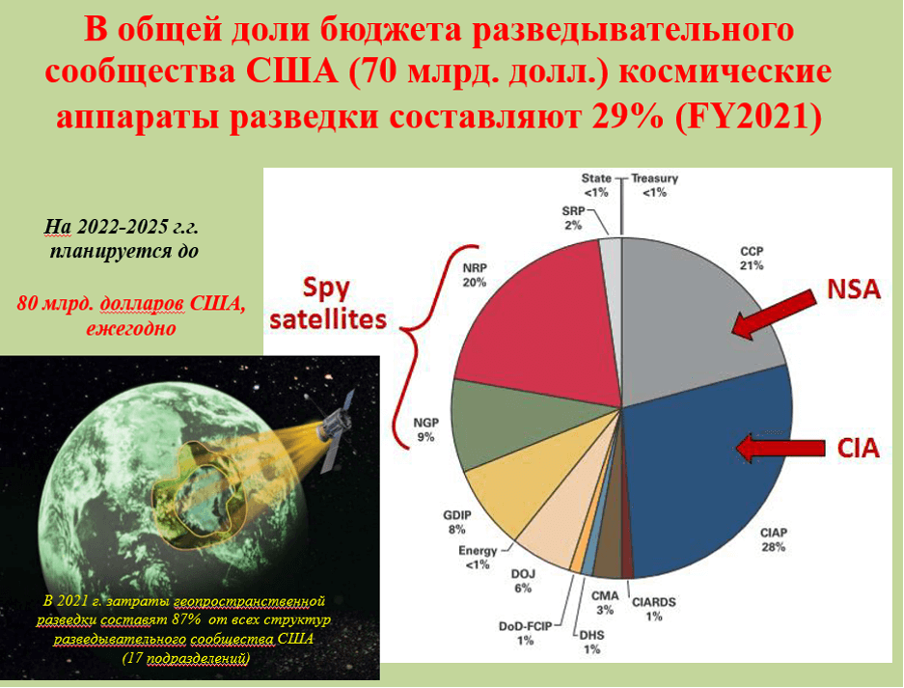

Structurally, the domain of U.S. military strategic ISR satellites falls under the National Reconnaissance Office (National Reconnaissance Office, NRO), which "seeks to protect the security of the United States, its citizens, and allies through unparalleled capabilities in space reconnaissance, observation, and reconnaissance" (NRO Director, December 2022).

Management Structure

In the United States, there are 17 intelligence agencies involved in reconnaissance, but the primary role is played by the "big five" agencies:

· Central Intelligence Agency (CIA),

· National Security Agency (NSA),

· Defense Intelligence Agency (DIA),

· National Geospatial-Intelligence Agency (NGA),

· National Reconnaissance Office (NRO).

At the tactical level, the relatively new U.S. SPACE COMMAND (SPACECOM) is responsible for ISR (partially formed in December 2021). The functional division of responsibilities between NRO and SPACECOM has not yet been finalized (as of November 2022).

The National Reconnaissance Office (NRO) manages all reconnaissance satellites in the government's interest, and all information from tracking ground stations is received here. Its staff consists of 3,000 employees, and its annual budget is the largest among intelligence departments (about 15 billion USD) (as of 2022).

ISR materials are processed by the National Geospatial-Intelligence Agency (NGA). NGA provides global geospatial intelligence - global coverage of any territory on Earth, which "provides a decisive advantage for policymakers, the military, intelligence professionals, and rapid response services." NGA is the core of the U.S. National Geospatial Intelligence System.

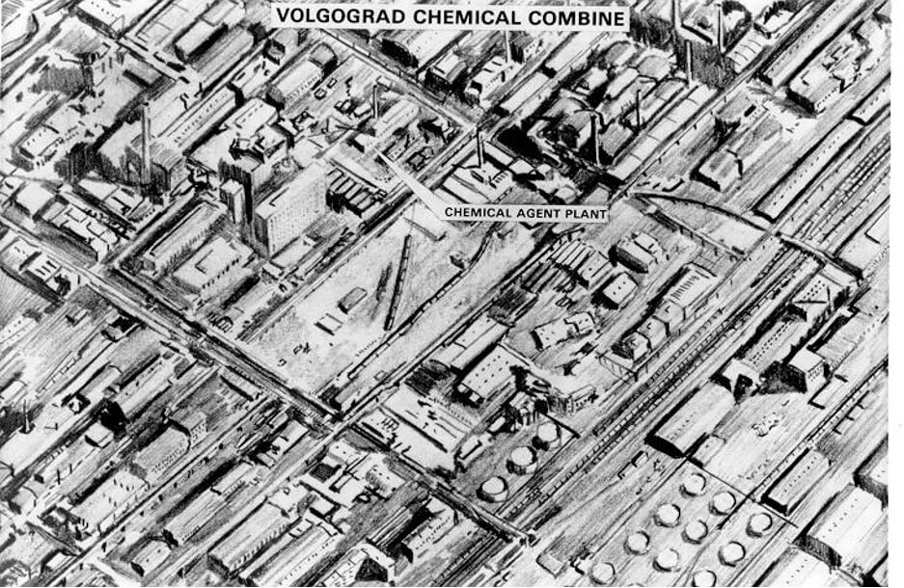

The U.S. Department of Defense divides reconnaissance satellites into strategic and tactical. Strategic ones, first of all, include proven, reliable, and expensive ones: optical KH-11 (and its modifications) and radar Topaz (and its modifications). Their main goal is to identify nuclear objects (factories for the production of nuclear weapons, mines and launch installations of strategic missiles, submarine-launched ballistic missile ports, scientific research institutes of strategic nuclear and missile development, etc.) of Russia, China, Iran, Pakistan, India, France, North Korea, and other countries. Additional functions for periods of local wars include the deployment and movement of the armed forces of a potential or unfriendly adversary, new developments in high-precision weapon guidance and counteraction, navigation installed on strategic air defense systems, submarine-launched ballistic missile systems, and ships in oceanic waters.

Strategic Military Satellites ISR of the USA in the Optical Range (Panchromatic Mode)

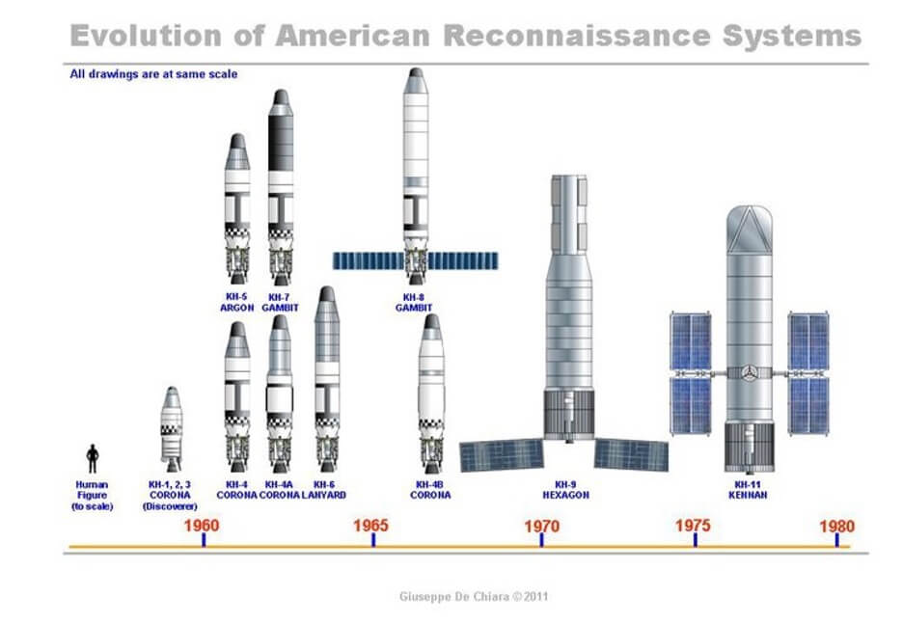

The history of optical reconnaissance satellite systems began in 1960. The current state of the last 5-7 years is as follows, based on available data.

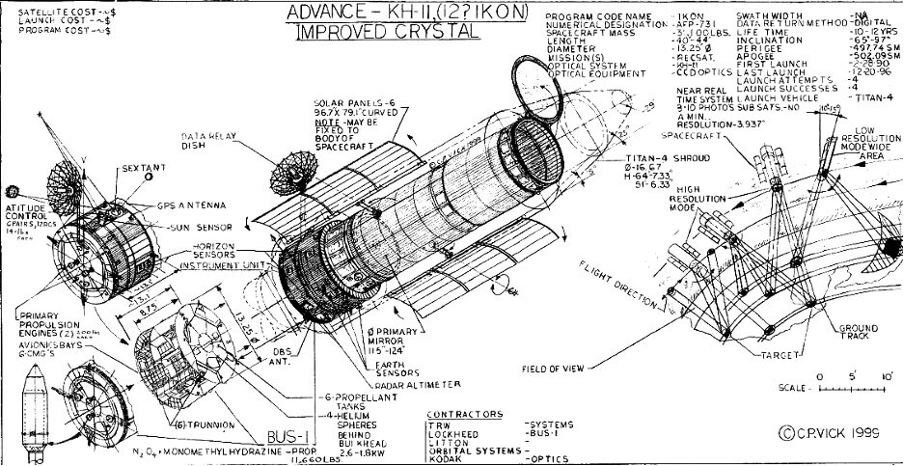

The design of reconnaissance satellites with digital imaging like KH-11 was classified for 36 years.

Optical satellites in orbit are the latest, now obsolete, spacecraft under the "FIA-Optical" program (Future Imagery Architecture – Optical, program canceled in 2005). They succeeded the reconnaissance satellites KH-11 Crystal.

Given their minimum orbital lifespan of 10 years (in practice, satellites operate for about 12 years), they will reliably transmit strategic reconnaissance information until 2030.

Some details about the characteristics of KH-11.

To clarify, NRO strives to maximize secrecy for all data on these satellites, even not changing the public names of new, not yet launched satellites, creating uncertainty in the nomenclature like KH-12, Misty, etc. For example, KH-12-6 and KH-12-7 are named "EIS (Enhanced Imagery System)," but they are upgraded versions of KH-11. KH-11 satellites were built in several blocks, each incorporating improvements. The optical system likely remained mostly unchanged, while sensors and avionics were improved. With the advent of the more powerful Titan-4 rocket, the amount of fuel was likely increased to extend the service life. Identification of blocks is preliminary and based on orbital behavior and launcher versions. The latest series, Block 5 (KH-11 17,18): possibly a further upgraded version. The first of these satellites was placed in an unusual 74° orbit, so it could be something else, possibly a covert variant of Misty 3. Misty may be a derivative of the KH-11 design.

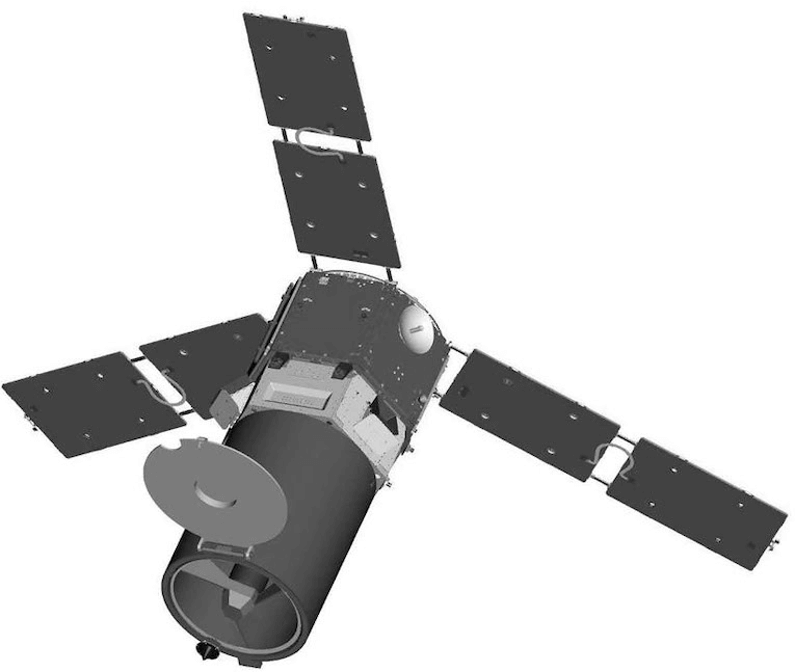

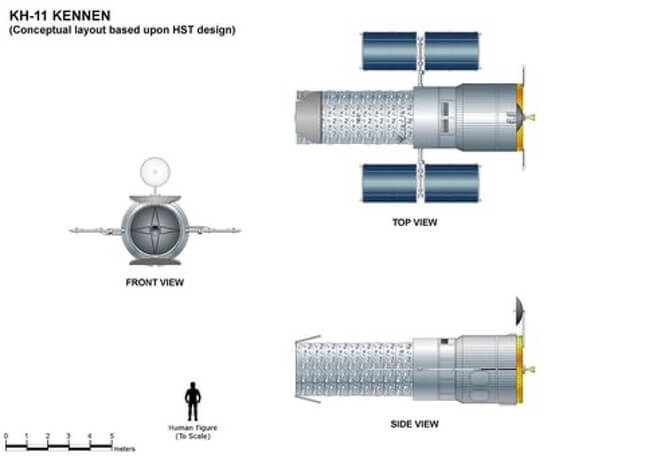

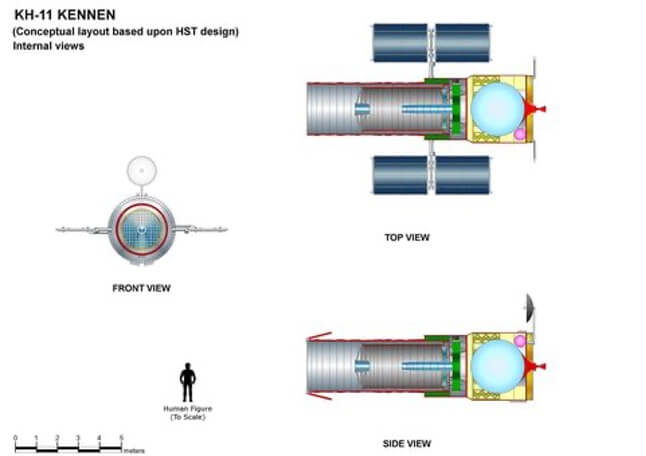

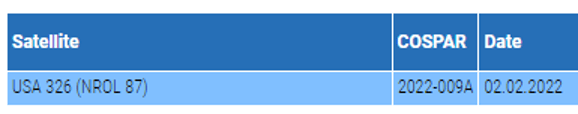

The high-precision model of the reconnaissance satellite KH-11 with digital imaging in space illustrates the characteristics of KH-11 "Short Hubble" with a shorter telescope tube and a smaller focal length, as well as a much smaller instrument compartment in the aft section than the full-scale Hubble. This corresponds to the equipment provided by NASA and telescopic images of KH-11 in space obtained from observatories. KH-11 satellites can also capture images of other satellites. Like NRO telescopes, the optics were designed for observing objects on Earth to provide resolution up to 10 cm from a distance of 320 km and an oblique range of up to 480 km.

Although satellites are often thought of as small devices, KH-11 satellites are actually very large vehicles. They are roughly equivalent to the Hubble Space Telescope, with a length of 19.8 meters, a width of 3.05 meters, and a weight of about 18 tons. The main part of the design contains a telescope with a 2.4-meter diameter mirror and various sensors calibrated for Earth observation, not fainter objects in deep space. In the 90s, the Hubble telescope was deployed to Earth and used for reconnaissance purposes by the US Department of Defense. The new KH-11 satellites have a 3-meter diameter mirror. Thanks to this large mirror, the instruments have high resolution, allowing the identification of objects as small as 6-10 cm in test performance. However, actual imaging, under good visibility conditions, is within 15-25 cm per pixel, allowing for the analysis of details of new or prospective military equipment of Russia, India, and China installed on military vehicles or undergoing testing: ground and naval, mobile missile systems, air defense, missile defense, submarine-launched ballistic missiles, such as laser sights, guidance and automation systems, new principles of high-precision weapons, etc. In recent years (starting from ~2018), archival optical imagery (with the classification DSP) of KH-11 is mixed (overlayed) with commercial images and distributed, including to friendly countries upon request.

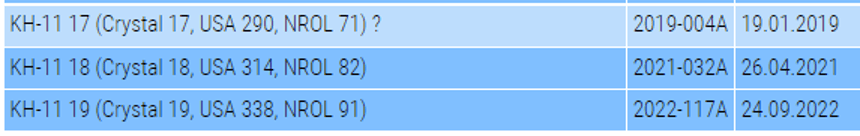

As of winter 2022, there are 3 KH-11 satellites in orbit, including new components on KH-11 18 and 19.

The launch of NROL 87 carries an unidentified payload for NRO.

Details are unknown. According to contract requirements for this launch, the orbit should be 512 km with an inclination of 97.4°. It is assumed that this could be a next-generation electro-optical reconnaissance satellite ISR.

Details are unknown. According to contract requirements for this launch, the orbit should be 512 km with an inclination of 97.4°. It is assumed that this could be a next-generation electro-optical reconnaissance satellite ISR.

Thus, following the classic approach to satellite reconnaissance of the territories of Russia, Iran, and China, verified for about 40 years, there are currently 4 strategic optical satellites in orbit.

Thus, following the classic approach to satellite reconnaissance of the territories of Russia, Iran, and China, verified for about 40 years, there are currently 4 strategic optical satellites in orbit.

Video and digital photo imaging allow real-time monitoring of reconnaissance objects on a large high-resolution screen in intelligence centers. Conducting optoelectronic reconnaissance, for example, of the territory of Russia in a 3600 km strip with two satellites for over 8 hours a day, or with three satellites for over 12 hours a day. Image formation is achieved using a CCD matrix, which has been improved to 40,000 x 40,000 pixels in the 2023 satellites. The manufacturer is ITT Exelis in Rochester, New York.

Data from the most sensitive sensors are sent to the National Geospatial-Intelligence Agency (NGA) for further processing. It is necessary to use at least two satellites simultaneously to ensure the required coverage and avoid the need for too frequent changes in satellite orbits. KH-11 and its subsequent designs are linked to satellite data relay spacecraft (SDS) and their successors (including TDRSS, NASA relay satellites) for real-time transmission to NRO ground stations. This is done through relay satellites like Quasar or Satellite Data System (SDS-1, SDS-2, SDS-3, SDS-4, new Transport Layer), which operate in Molniya orbits and geostationary orbits.

Note on the KH-11 telescope: a shorter focal length means that NRO telescopes can display an area 100 times larger with high resolution than the wide-angle camera of Hubble-3, the visible/infrared range instrument that became the most advanced and widely used sensor on Hubble. Due to imaging areas 100 times larger in a single image. Unlike Hubble, the secondary mirror on the NRO telescope can be moved either from the ground or using onboard tools. This can be used to bring the image into extremely precise focus. The secondary mirror is supported by 6 struts, and at the bottom of each strut are servo motors. Six engines can maneuver all these struts to adjust the secondary mirror for the best possible focus. The instrument compartment on NRO telescopes is only 152.4 cm in height, smaller than on Hubble.

For a 2.4 m diameter mirror observing at a wavelength of 500 nm, the Rayleigh criterion imposes a diffraction-limited resolution of 0.05 arcseconds. At an altitude of 250 km, this translates to a resolution of 6 cm on the surface. It is worth noting that this maximum is theoretical, and in practice, the resolution will be less due to atmospheric distortions and because the satellite is unlikely to be precisely above the observed location. To achieve high-quality images, an optical system with high contrast and optimized signal-to-noise ratio is applied, as well as time-delay and integration (TDI) technology on multi-line CCD structures (6 accumulation modes from 8 to 64 times).

For a 2.4 m diameter mirror observing at a wavelength of 500 nm, the Rayleigh criterion imposes a diffraction-limited resolution of 0.05 arcseconds. At an altitude of 250 km, this translates to a resolution of 6 cm on the surface. It is worth noting that this maximum is theoretical, and in practice, the resolution will be less due to atmospheric distortions and because the satellite is unlikely to be precisely above the observed location. To achieve high-quality images, an optical system with high contrast and optimized signal-to-noise ratio is applied, as well as time-delay and integration (TDI) technology on multi-line CCD structures (6 accumulation modes from 8 to 64 times).

NRO collaborates with the National Aeronautics and Space Administration (NASA). Currently, NASA has received one telescope from NRO with KH-11 technology (only 2 telescopes remain on Earth) for the infrared mission WFIRST.

Work is underway on new strategic military satellites in the optical range to replace KH-11. The weight of these satellites will not exceed 1.9 tons (compared to old satellites with 15 tons). The key feature is on-board image processing and encrypted communication channel for direct data transfer to intelligence centers on the ground. The plan is to launch 4 new satellites from 2023. The developers of the new satellites to replace KH-11 are old competitors Lockheed Martin and Boeing, now working in tandem. NRO spent four years persuading Congress to fund these new satellites with new microchips, a new CCD matrix, an on-board image processing processor (manufactured by Boeing), laser inter-satellite communication receivers, channels for disseminating geospatial information to the commander's tablet on the battlefield (as part of the Joint All-Domain Command and Control - JADC2 system), and an efficient power supply system.

Test devices for these satellites are already in orbit as part of KH-11 launched from 2019 to 2022. Over the years, KH-11 has undergone significant changes. Initially launched with a Titan 3D rocket with a 304.6 cm payload fairing, it now uses Delta IV with a 487.68 cm fairing. However, does only one fairing size exist? In other words, smaller payloads can fly with a larger fairing than necessary.

It is known that almost all military ISR (Intelligence, Surveillance, and Reconnaissance) imaging systems contain detector arrays (CCD) manufactured using planar processes designed for electronic integrated circuits. This leads to the need for large and complex optics for proper focusing on imaging objects. Recent industrial achievements have led to the creation of curved image sensors with a small visible light area. The Focal arrays for Curved Infrared Imagers (FOCII) program plans to use industrial achievements in the field of visible (optical) sensors, extending these capabilities to large-format cryogenically cooled infrared sensors (achieving IR resolution of 25–30 cm per pixel) with extreme curvature to significantly improve performance while reducing the weight, volume, and cost of optics.

Scalable technologies for bending existing wide-format high-performance infrared focal plane arrays with a small radius of curvature to achieve maximum performance, as well as demonstrating the bending of smaller-format focal plane arrays with extreme curvature to provide minimal form factors while maintaining high performance. The new, so-called KH-11, apparently use this technology.

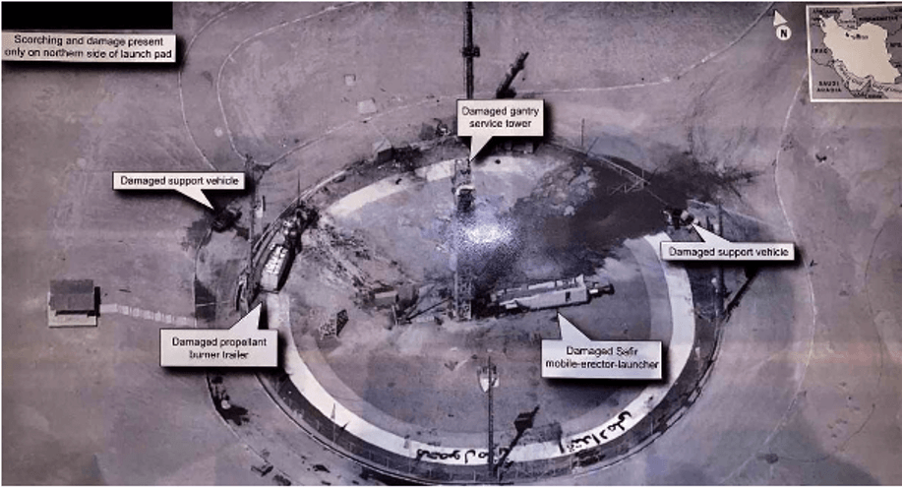

Examples of shots from KH-11:

The images are now officially declassified, but they do not correspond to the original images.

Fig. August 2019 photo of a rocket explosion at a spaceport in Iran. Source: Twitter of U.S. President Donald J. Trump (@realDonaldTrump)

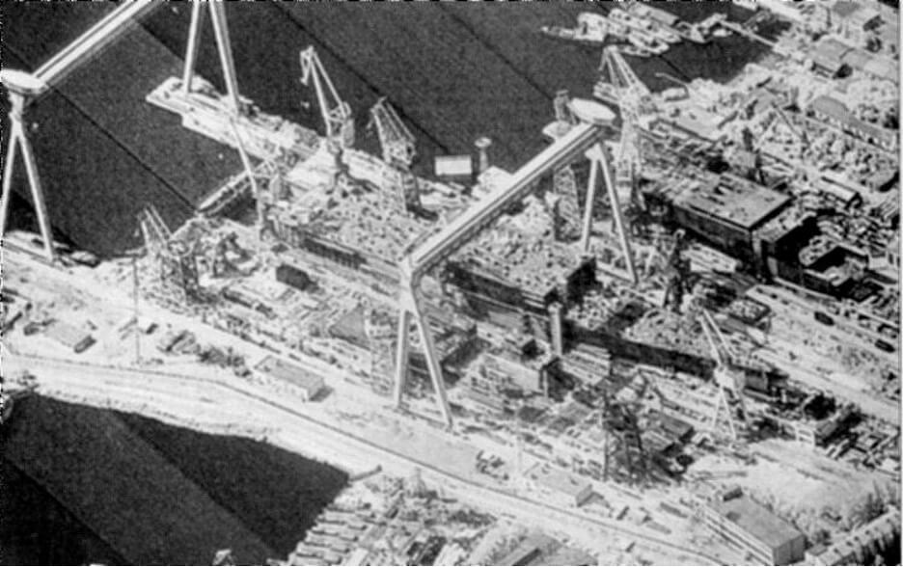

Fig. Severodvinsk city, Russia, 2017

Fig. Severodvinsk city, Russia, 2017

Fig. July 4, 1984, Nikolaev city, USSR

The U.S. Department of Defense and the Defense Advanced Research Projects Agency, DARPA, believe that over time, optical space reconnaissance can be completely replaced by radar reconnaissance (SAR and new technologies based on physical principles). In laboratory conditions, SAR has achieved resolutions less than a millimeter, and although the real resolution when observing a target from hundreds of kilometers will be significantly less, this technology has the potential to take observation from orbit beyond the physical limitations that existed until now. At radar frequencies, both amplitude and phase are measured. At optical frequencies, only intensity (amplitude) is measured, not phase. This can be circumvented to some extent by determining the phase compared to a reference, but it does not work if you cannot control the phase of the image, i.e., the light coming from the Earth. Thus, optical visualization, for example, with synthetic aperture, fundamentally does not work. The Rayleigh criterion determines the resolution measure of an optical system; it does not determine how small objects you can see. It determines how close objects can be to each other and still be resolved as two separate objects. U.S. scientists working on ISR reconnaissance are looking for and testing other approaches in the optical range.

Achieving quantum-level sensitivity in compact IR detectors operating at room temperature will change battlefield observation systems, night vision, and ground and space visualization.

Radar Strategic Satellites by NRO

ISR radar reconnaissance is conducted in a wide range with wavelengths from 1 mm to 1 m and corresponding frequencies from 0.3 to 300 GHz.

Satellite radar in the L-band (wavelength 15.0–30.0 cm) provides strong reflected signals, mainly from larger objects on the Earth's surface, partial penetration of radio waves through snow and vegetation covers, and, under certain conditions, through sand and soil. Shorter waves used in the C-band (3.8–7.5 cm) and X-band (2.4–3.8 cm) allow for the detection of boundaries of small terrain objects; moreover, the radiation in these bands tends to reflect more strongly from vegetation and snow covers, as well as from the soil. It is the development of military space radars that made it possible to penetrate the ground up to several tens of meters away by using new frequency ranges (without taking into account natural limitations such as soil moisture, density, etc.).

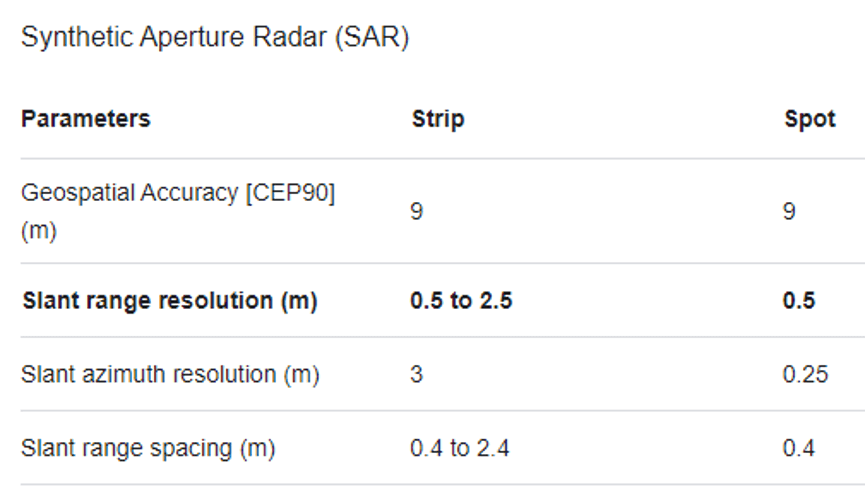

Military radar satellites have achieved ground spot resolutions of 10 x 10 cm, and commercial satellites are approaching this value (ICEYE).

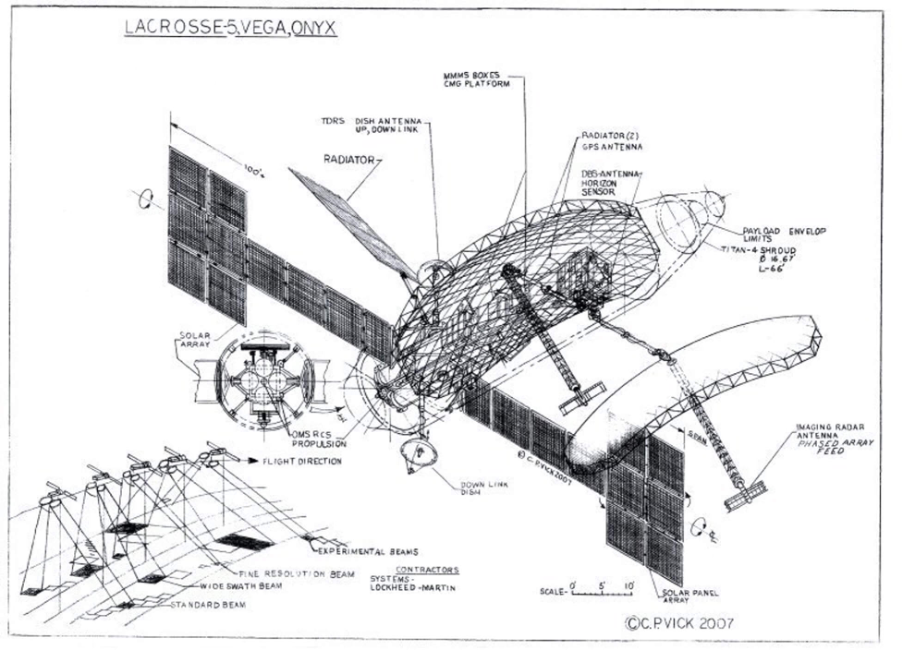

The existing satellites in the Topaz 4, 5 orbit are the radar component of the Future Imagery Architecture - Radar (FIA-Radar) system. They are successors to the Onyx radar satellites.

The first satellite was launched in 2010, at least four years later than the initial schedule. The second satellite was launched in 2012. A total of 5 satellites were launched. The on-orbit life cycle of radar satellites is shorter than optical ones due to significant power consumption.

|

Topaz 4 (FIA-Radar 4, NROL 45, USA 267) |

2016-010A |

10.02.2016 |

|

Topaz 5 (FIA-Radar 5, NROL 47, USA 281) |

2018-005A |

12.01.2018 |

The contract for the development of the Future Imagery Architecture radar program (FIA-R) was concluded with Boeing in 1999. The Synthetic Aperture Radar (SAR) of this series is usually placed in a retrograde orbit at an altitude of 1,100 km. With an observation angle of 30–60°, such an orbit allows expanding the swath by 1/3 with an energy loss of less than 2 dB due to an increase in the distance to the Earth's surface. An analysis of the characteristics of the launch vehicles used to launch the FIA Radar shows that the mass of the SAR TOPAZ satellite cannot exceed 8 tons. In technical characteristics, the new product turned out to be largely similar to the old Lacrosse.

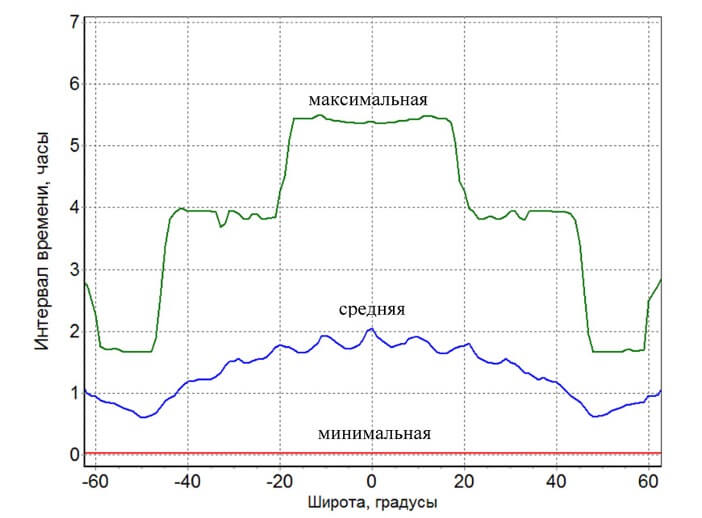

Temporal factor of reconnaissance has remained at the same level, allowing SAR to capture images of the Earth's surface with global coverage. The observation results are transmitted in real-time to the NGA Processing Center via radio channels. It is possible to conduct reconnaissance of the Russian territory with two SAR satellites with a swath of 4000 km for over 9 hours and with three SAR satellites for 14 hours per day.

One way to achieve high performance and operability with a limited number of satellites is to increase the orbit height. High orbit allows for increased performance, swath width, observation frequency, and frame capture area. The main advantage of such satellites is the strict repeatability of the orbit track every two days, providing high operability for interferometry and coherent decoding tasks.

The main four satellites are placed in orbits with a retrograde inclination of 123°, while the fifth satellite is in a sun-synchronous orbit with an inclination of 106°, complementing the system for observing latitudes greater than 60°.

|

Satellite Number |

Semi-Major Axis, m |

Longitude of Ascending Node, degrees |

Inclination, degrees |

Argument of Latitude, degrees |

|

1 |

7,482,152.4 |

292.8 |

123.0 |

261.8 |

|

2 |

7,482,161.5 |

112.5 |

123.0 |

258.2 |

|

3 |

7,482,116.7 |

22.4 |

123.0 |

78.1 |

|

4 |

7,482,158.7 |

202.7 |

123.0 |

78.8 |

|

5 |

7,457,655.2 |

240.6 |

106.0 |

233.9 |

Table. Main Orbital Parameters of FIA-Radar TOPAZ Satellites

It is considered that choosing an inclination of 123° is necessary to improve the resolution of SAR. The orbit with a retrograde inclination does not provide a significant advantage in relative motion speeds and Doppler frequencies. FIA-Radar replaces the SAR Lacrosse. The choice of a 123° inclination orbit provides better conditions for solar panel illumination compared to the 57° orbit. The precession period of the orbit plane relative to the terminator plane for an inclination of 123° is about 95 days. For an orbit with an inclination of 57°, the precession has the opposite sign, and the satellite orbit plane passes the terminator every 46 days. While on the orbit, FIA radars rotate 180 degrees relative to each other and make close passes when they revolve around the Earth from south to north.

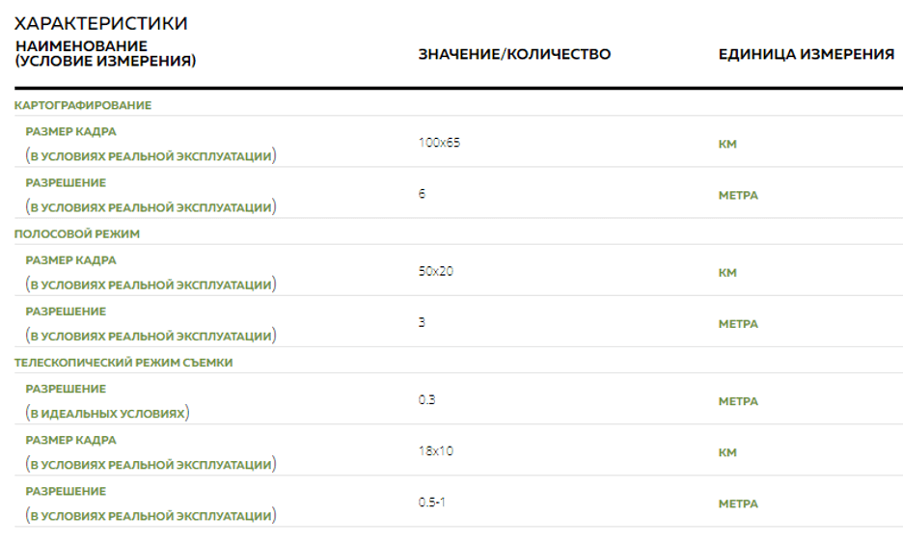

The onboard radar complex FIA-Radar has a parabolic antenna with a diameter of 6–8 meters and operates in the C-band (wavelength 5.6 cm). The detailed mode capture width significantly exceeds that of low-earth orbit satellites and ranges from 15 to 20 km. The average observation frequency in the latitude range of ±60° does not exceed two hours (one orbit). The maximum frequency is mainly due to the presence of a central blind zone of SAR for zenith angles less than 20° and does not exceed four to five and a half hours.

The potential observation frequency assessment is presented in the figure.

Fig. Observation Frequency of SAR Topaz (FIA-Radar)

The role of satellites with high-resolution radar images (approximately 30 cm resolution) has changed, and they are now used in conjunction with a number of electro-optical satellites with 7.5 cm resolution. This provides nine satellites for continuous coverage of strategic target areas.

Due to financial, political, and professional intrigues, the program was halted and then resumed to create New Radar, based on new digital principles, large antennas, and new SAR physical principles. The program remains with Boeing, but new contenders from commercial companies have been added. Apparently, New Radar will not go into orbit before 2024. Ground tests have been successful. Simultaneously, testing is underway for automatic target recognition of radar images under New Radar, Fiddler program.

American engineers believe that if they can solve the heat problem in orbit, they can increase both the amplifier power and the radar range. If the program is successful, the range of action of the space radar will increase by 2–3 times.

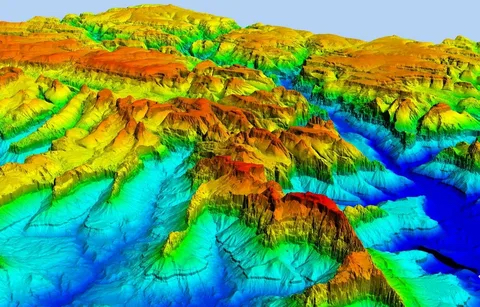

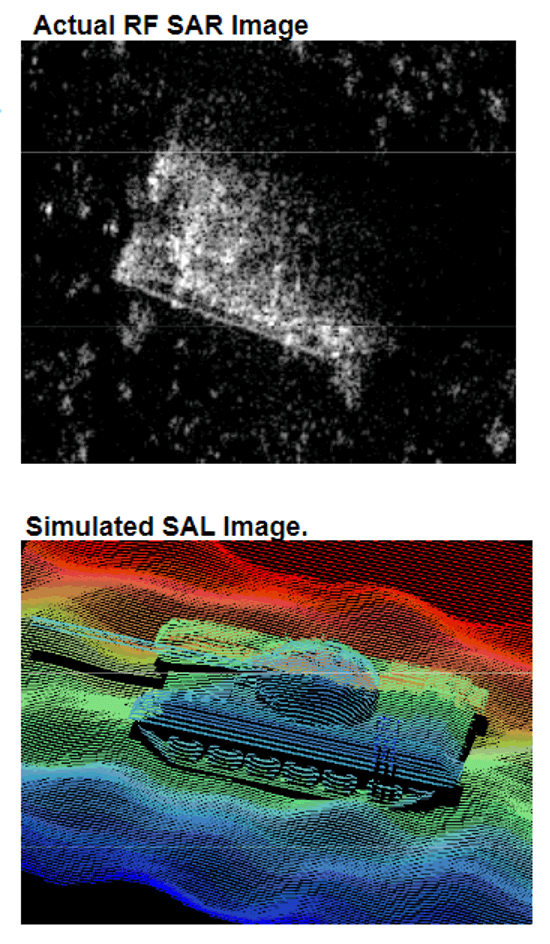

Simultaneously, a program called "Synthetic Aperture Ladar for Tactical Imaging" (SYNTHETIC APERTURE LADAR FOR TACTICAL

IMAGING - SALTI), funded by the Defense Advanced Research Projects Agency (DARPA), transfers synthetic aperture radar (SAR) technologies, tested in numerous radio frequency radars, to the field of laser radars, providing unprecedented resolution with significantly improved range, including for satellites. The program, from 2007 to 2010, was tested on the UAV Global Hawk and then transferred to a new space laser device. The SALTI automatic software detects the target and builds its 3D model.

Scientists at DARPA believe that the SALTI trials and the development of laser technology allow for the creation of ISR spacecraft on a unified sensor basis, known as "LADAR," without the use of electro-optical and radar sensors. The results in terrain resolution enable achieving 6-10 cm per pixel (beyond the diffraction limit constrained by the physical dimensions of the aperture), while the slope range provides an unmatched advantage compared to optics and radar distortions. Most likely, radar and LADAR are the future developments in ISR, post-2030.

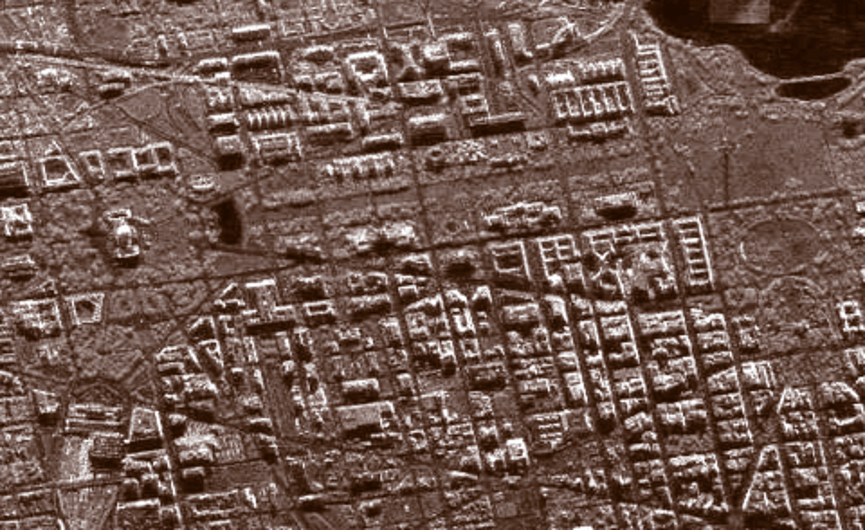

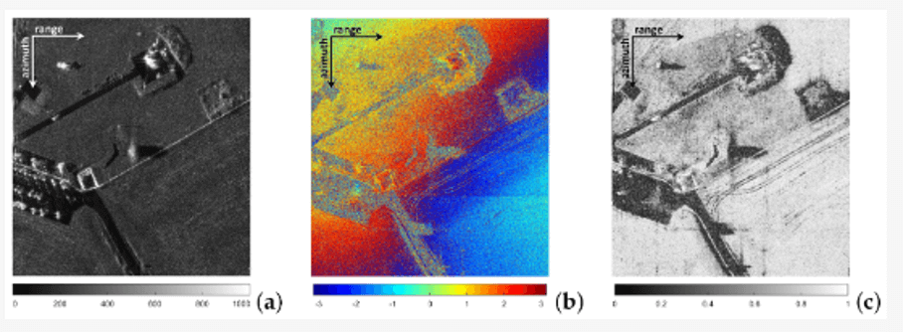

Examples of radar imaging from the TOPAZ spacecraft:

Fig. Resolution 1 meter

Fig. Resolution 10 cm (4-inch resolution (Spot mode and contiguous Stripmap)

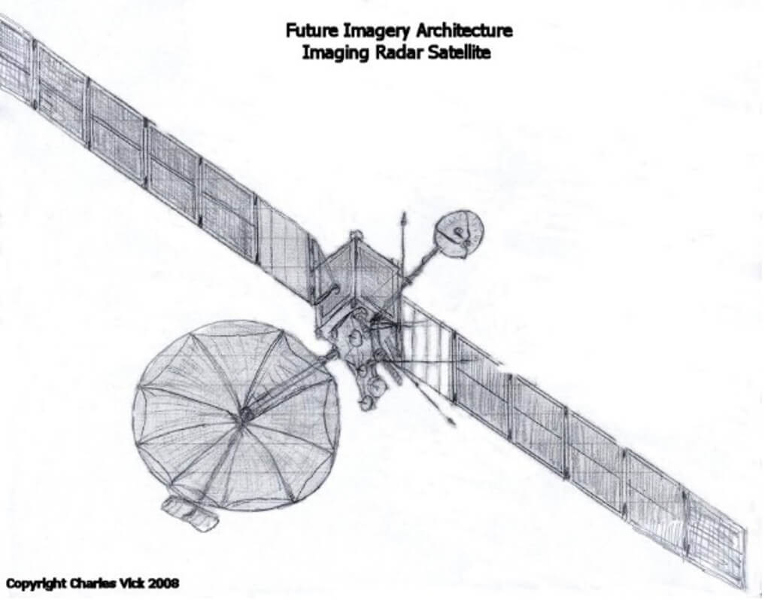

Development of a new strategic radar began in 2007.

In 2005, the name Space Based Radar (SBR) was changed to Space Radar (SR) to represent a fundamental restructuring of the joint program of the DoD and the intelligence community (IC). The US Air Force restructured the space radar program for the 2006 fiscal year in response to a significant budget cut for the 2005 fiscal year, conducted by lawmakers concerned about the potential cost of the program. At that time, the US Air Force planned to create a group of nine satellites with a total operational cost of $34 billion by 2025.

The Department of Defense and national users agreed on the path to create a unified national space radar system that meets the nation's needs in terms of cost. SR program partners committed to delivering an affordable, capability-oriented system as part of a horizontally integrated system intended to meet the needs of national intelligence and unified command (C4ISR) by providing a large volume of easily achievable tasks for image formation using synthetic aperture radar (SAR), surface moving target indication (SMTI), and high-resolution terrain information (HRTI).

From this point on, conditionally, the strategic radar began to be called NEW SPACE RADAR.

The program has two major technological factors. The first is the development of a space-certified electronically steered array, and the second is the accompanying radar electronic block, which is part of the radar payload. These are the two most complex payload subsystems required for the successful implementation of this program.

New Space Radar is not planned as a separate, isolated program. Although a space radar alone cannot provide global continuous ISR or full horizontal integration, it can be a catalyst for some revolutionary ideas and new possibilities in these areas.

In the process of developing the new radar, insurmountable technical problems were encountered, which had to be overcome to fulfill the Technical Task. Therefore, the US military NRO and NGA settled for an improved TOPAZ.

The launch of the New Space Radar is scheduled for 2023.

Overall, the development pattern of strategic ISR spacecraft is presented below.

Fig. Development pattern of strategic ISR spacecraft

A significant note from the leaders of the military-industrial complex and US intelligence, regarding the development of ISR spacecraft, in light of the Russian special military operation in Ukraine, serves as a common conclusion:

"The Russian special military operation in Ukraine highlights new options for ISR use and the advantages of integrating a hybrid approach—several types of ISR satellites to obtain a more complete picture of evolving threats. A wide range of ISR visualization capabilities is more important than ever. In the current conflict in Ukraine, whether ISR is used for threat protection or aid in destruction, small satellites provide unique advantages. When you combine [panchromatic] images with other types of images, such as multispectral, hyperspectral, or radar, you can really improve things like spectral resolution, identification, and target detection, overall enhancing image quality. Together, these sensors help paint a complete picture of the battlefield and provide continuous observation of the fighter so that they don't miss their target. Joint use of multiple types of ISR images is the future of ISR space missions." - CEO of [Millennium Space Systems](https://www.millennium-space.com/), contractor for NRO and US Space Forces Command.

"Providing ISR in the conduct of war in Ukraine has shown that satellite data only from military satellites is not only insufficient but essentially, commercial Earth observation satellites are now reconnaissance satellites, especially for future large-scale wars." - Director of National Intelligence, USA, December 2022.

Technological development of new strategic ISR spacecraft in the USA is progressing quite slowly, but it is a solvable problem. However, the real situation has revealed a rocket problem—launching heavy spacecraft into orbit during the period 2023–2027. Of course, this is a separate topic, but the essence is that the USA military has to urgently implement tactical ISR tasks due to various reasons. Powerful rockets for launching ISR spacecraft into low and geostationary orbit are simply lacking. This is a separate issue."

Tactical ISR Satellites

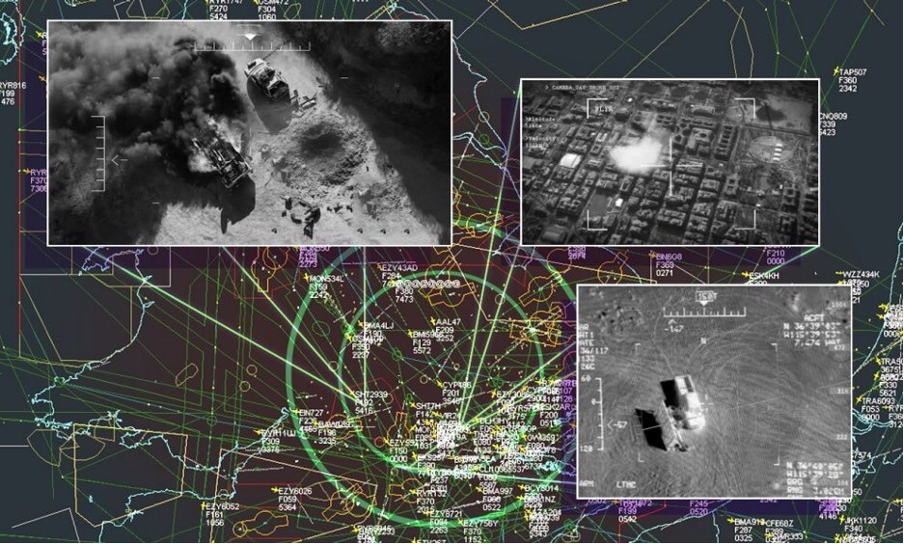

Historically, ISR was not the responsibility of the U.S. Space Command—now the U.S. Space Force. It was primarily the effort of the intelligence community. However, the new command needs to address this issue to support the battlefield, as demonstrated in the Project Convergence exercises, where data on targeting precision weapons based on satellite imagery was obtained within 20 seconds. Scenarios of SPACE FLAG, managing tactical battlefield operations by the U.S. Space Command ISR components, were practiced in Ukraine.

The head of the U.S. Space Force wants the new service to take on a new mission: providing tactical satellite imagery to the joint forces. He did not explain whether this means the service will attempt to build its own satellite constellation; however, the director of the Space Development Agency suggested that the idea might include creating space forces and launching a new satellite constellation for imagery. Currently, there is no clear plan for who in the U.S. Department of Defense will create these satellites. There is not even a definite plan for what this overall constellation will look like. There are many internal debates on this matter. But the military's vision remains the same: someone must create a layer that provides reliable tactical ISR during wartime.

Other achievements, such as artificial intelligence that can instantly process images, and the development of new orbital mesh networks that can accelerate the delivery of satellite data to the battlefield, allow military personnel to access this data in seconds, not hours or days.

Additionally, efforts at the tactical space level promise to provide target designation for combat aviation beyond line of sight, significantly expanding the battlefield.

In addition, the Space Development Agency (SDA), which joined the U.S. Space Force in October 2022, is creating tactical geospatial intelligence (GEOINT) capabilities within its National Defense Space Architecture (NDSA). The basis of this architecture is a mesh network in orbit, called the transport layer, consisting of satellites in low Earth orbit, connected by optical intersatellite communication links. The agency wants to use the transport layer to connect commercial image satellites to the Tactical Intelligence Targeting Access Node, or TITAN, a new scalable portable ground station currently in development, which can process images using artificial intelligence and distribute this data across the battlefield. In other words, SDA will provide the network component of the army's tactical space level.

Experimental ISR Satellites

Over the past 10 years, the U.S. military (NRO, Air Force Research Laboratory, US Space Force, DARPA, US Air Force, US Navy, Northrop Grumman, Lockheed Martin, Blue Canyon Technologies, Millennium Space, Astro Digital, SA Photonics, Trident Systems, Blue Canyon Technologies) has conducted a significant cycle of launching small tactical ISR satellites (over 20 satellites) for experimental purposes in the future ISR development program and the Blackjack DARPA program (over 25 satellites). The space component was systematically integrated with the ground-based one. These small satellites had a lifespan of no more than 3 years in orbit. It is fair to say that the U.S. military ordered small satellites as early as 1990 (Northrop Grumman), and then launched a dozen experimental small satellites. However, in recent years, there has been a deceptive impression that they consciously ignored serial tactical space reconnaissance with small satellites in favor of the aviation component and the promotion of strategic and tactical UAVs. This is partially confirmed by the surge of European commercial companies in the radar range, both heavy satellites (Airbus Defence and Space) and small satellites (ICEYE). Moreover, China has overwhelmed all countries with reconnaissance satellite launches and Earth observation satellites (in China, it is difficult to distinguish pure military satellite reconnaissance from civilian Earth observation).

Therefore, it is expected that from 2023 to 2025, there will be a surge in launches of U.S. military serial small satellites with new developed ISR technologies, a lifespan of 7 to 10 years in orbit, and the ability to be deployed to any orbit within a week (modular payload assembly principle) on demand.

From 2005 to 2020, experimental test satellites with ISR payloads were launched to test the accuracy and speed of battlefield situational information transmission, with a short time factor for launching into orbit. There was some information about these satellites, including:

SeeMe Satellite

SeeMe (Space Enabled Effects for Military Engagements) — is a prototype small satellite created by Raytheon for DARPA for the timely and persistent delivery of on-demand satellite imagery for mission planning.

The DARPA SeeMe program aimed to provide U.S. mobile forces with on-demand access to tactical space information in remote and beyond-line-of-sight conditions. If successful, SeeMe would provide small squads and individual commanders the ability to receive timely images within 90 minutes of their specific location overseas directly from a small satellite by pressing a button on a tablet or mobile phone, which was impossible with military satellites in the mid-2000s. DARPA planned for SeeMe to complement drone technology, which provides local and regional high-resolution coverage but cannot cover extensive territories without frequent refueling. SeeMe, as designed, sought to support fighters in foreign territories simultaneously without any logistics or technical maintenance costs, except for the soldiers' handheld devices.

The SeeMe constellation could consist of several dozen satellites, each in very low Earth orbit for 60–90 days, after which it would deorbit and completely burn up, leaving no space debris and posing no risk of re-entry into the atmosphere.

The SeeMe satellite utilized the DARPA program Airborne Launch Assist Space Access (ALASA), which is developing an aviation platform for launching satellites with payloads of about 45 kg. ALASA provides a cost-effective and rapid launch of small satellites into any required orbit, which is currently impossible from stationary ground launch pads.

The first SeeMe satellite was launched aboard the eXCITe satellite (PTB 1), which initially manifested on the Falcon-9 v1.2 in 2016, then on the Indian rocket PSLV. The satellite was launched as part of the SSO-A Spaceflight Industry multi-satellite program on the Falcon-9 v1.2 (Block 5) rocket, but apparently did not separate from eXCITe.

TacSat -3

TacSat-3 (JWS D2) — a small technology mission of the Air Force Research Laboratory.

The project is funded by the U.S. Department of Defense's Defense Advanced Research Projects Agency (DARPA) as part of Phase II of a four-stage approach to developing modular platforms for satellites. The result of the TacSat 3 mission is used to support the sensor payload of the Advanced Responsive Tactically Effective Military Imaging Spectrometer (ARTEMIS), also being developed by the AFRL. The main payload of TacSat 3 was a hyperspectral sensor, and the satellite platform had a standardized avionics package developed by the Air Force Research Laboratory. The satellite achieved a ground resolution of 4 meters with HSI, allowing it to detect and identify tactical targets. It also featured the Navy Secondary Data-X payload for communication with IP-based buoys. Swales Aerospace designed, built, and tested the operationally responsive space modular bus (ORSMB) for the TacSat 3 mission. TacSat 3 was a prototype for the first satellite of the Operationally Responsive Space (ORS) program, ORS 1. TacSat 3 was deorbited on May 1, 2012, after almost three years of successful mission operations.

The tested parameters of this satellite are still considered the highest, both in terms of resolution for hyperspectral imagers (4 meters) and filtering (10 nm).

Currently, innovative military small satellites continue to operate, including those with ISR tasks:

U.S. Space Force (USSF)-12 Satellite

The U.S. Space Force Station (USSF)-12 was launched on 14.07.2022 from Cape Canaveral to a geosynchronous orbit (GEO) with a wide field of view (WFOV). The USSF-12 wide field of view and jointly operated ring is a Space Systems Command (SSC) space trials program that demonstrated the operation of an innovative infrared (IR) sensor and confirmed the ability to host multiple missions on one satellite structure.

The effectiveness of new integrated space sensing technologies has been proven in combating emerging threats from Russia, Iran, China, and potentially India. This essentially serves as a testbed, a crucial technological component of the leading U.S. Department of Defense (DoD) program - "Missile Warning, Reconnaissance, and Defense (MW/MT/MD)," within which the Space Systems Command (SSC) collaborates with the Space Development Agency and the Space Research Agency.

EAGLE (ESPA Augmented Geostationary Laboratory Experiment)

EAGLE (ESPA Augmented Geostationary Laboratory Experiment) - an experimental satellite created by the Air Force Research Laboratory (AFRL) and operating under the Space Test Program (STP).

AFRL ordered the Eagle bus from Orbital in 2012. It consisted of an ESPA adapter equipped with an engine module and Moog Broad Reach avionics, software, and a GPS receiver. EAGLE carried no less than five payloads, with a total payload weight of up to 1086 kg. It existed in orbit for over a year. EAGLE carried the following payloads (it is known that three of them were fully deployed):

· HTI-SpX (Hypertemporal Imaging Space Experiment), provided by the Management of Space Vehicles of the AFRL, was designed to help improve understanding of hypertemporal visualization, involving the blending of images taken from various points on Earth at several different spectral wavelengths over regular intervals of time.

· Mycroft – a special, detachable additional satellite that drifts to a distance of approximately 35 km from EAGLE, carefully advancing over several months to a distance approaching 1 km.

· CEASE-III-RR - Compact sensor for environmental anomalies. Detection of nuclear radiation.

· ISAL (Inverse Synthetic Aperture Ladar) for obtaining high-resolution images, the resolution of which is not limited by the diffraction limit of a telescope collecting imaging data. This makes it an ideal method for obtaining images of space objects in geostationary orbit around Earth (GEO).

· ARMOR (AFRL-1201 Resilient Spacecraft Bus Development Experiment).

The first EAGLE satellite was launched in 2018 as a secondary payload in the AFSPC 11 mission on the Atlas-5 rocket. Shortly after reaching orbit above the geostationary belt, it deployed three subsatellites (Mycroft and two unidentified ones, USA 286 and USA 287). The second one (resulting from ARMOR) is scheduled to launch in 2023 - NTS-3, an experimental navigation satellite, will expand the boundaries of modern position, navigation, and timing (PNT) technologies to pave the way for a more flexible, reliable, and resilient architecture for satellite navigation technologies. The goal is accurate geopositioning of a fighter on the battlefield.

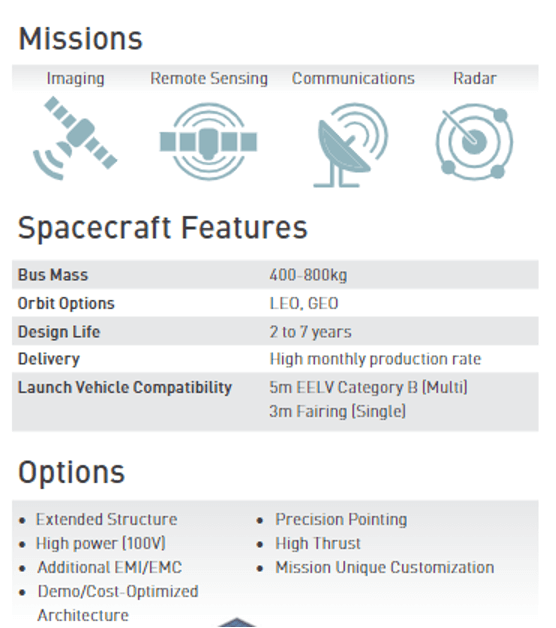

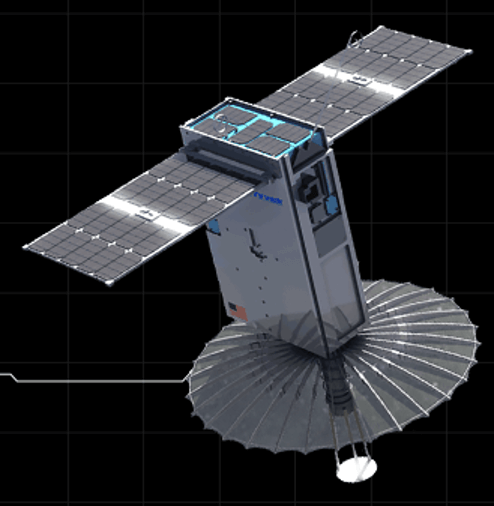

LM 400 Satellite

Lockheed Martin has introduced a new line of military tactical reconnaissance, observation, and surveillance (ISR) satellites designed to provide armed forces with long-range tracking of moving targets in a hostile environment in near-real-time.

To achieve this goal, a constellation of satellites must be in orbit, providing the foundation for the entire U.S. DoD system. Lockheed's latest contribution to achieving this goal is a new lineup of ISR satellites. These refrigerator-sized spacecraft, powered by solar panels, are based on the medium-sized LM 400 satellite bus and have an open architecture that allows them to be produced in large quantities for increased availability. The goal is to create a constellation of satellites that can leverage various means for faster search-correct-finish. This satellite can be reprogrammed directly in orbit to perform new tasks.

Tactical ISR satellites use an Open Mission System (OMS) and a Universal Command and Control Interface (UCI), allowing them to work with various combat platforms and systems. This is a software-defined platform. Additionally, it is equipped with a secure data processing system, supporting the tasking of low-latency air sensors, onboard data processing, secure communication, direct transmission of situational awareness data, and target information transmission.

Digital design and manufacturing accelerate the ability to deploy future-oriented, reliable constellations with advanced technologies to perform tactical tasks on the battlefield.

Tactical ISR satellites based on LM 400 have the following advantages:

· Compatibility: following open standards such as Open Mission System (OMS) and Universal Command and Control Interface (UCI), these tactical ISR satellites easily connect to other combat platforms and command and control systems of all services.

· Adaptability: Lockheed Martin's platform for programmable satellite capabilities, SmartSat™, offers the ability to rapidly develop and deploy new mission capabilities in orbit, outpacing the pace of threat development.

· Power: The high-powered LM 400 can also support a payload of up to 14 kilowatts and up to 1,500 kg mass, providing extended operation for a wide range of sensor technologies.

· Autonomy, resilience, combat readiness: This tactical ISR satellite line, operating on board data processing and fault-tolerant communication, provides the ability for real-time sensor management, mission data processing in orbit, secure and direct downlink communication with situational awareness.

ISR technology will enable the creation of larger satellite constellations, as well as their rapid production and deployment. Lockheed Martin's new satellite production facility, Gateway Center, supports accelerated production, assembly, and testing of spacecraft in a unified, flexibly configurable space, providing multiple levels of security classification. Tactical ISR satellites based on LM 400 will play a key role in Joint All-Domain Command and Control (JADC2), allowing, for example, U.S. Air Force tactical fighters to better utilize space-based capabilities. Lockheed Martin is also developing and building 10 spacecraft based on Tyvak Mavericks.

Pony Express 2

As part of its SAJE project in early 2023, Lockheed Martin plans to launch three small satellites, funded with its own funds - two Pony Express 2 satellites and one tactical Intelligence, Surveillance, and Reconnaissance (ISR) and communication satellite - to create the first-ever space testbed for JADO. This testbed will provide a variety of sensors, processors, and communication channels in space for live demonstrations and experiments in orbit.

The timing for the deployment of this new space test range in 2023 could not be better, as SAJE will be available to participate in U.S. Indo-Pacific Command exercises "Northern Edge." SAJE will also be available for JADO demonstrations to advance the U.S. Air Force's Advanced Battle Management System (ABMS), the U.S. Navy's Overmatch project, and the U.S. Army's Convergence project.

Space has played an increasingly important role in JADO demonstrations and exercises over the last five years, but repurposing already-launched satellites for demonstrations within a few weeks has proven challenging. SAJE will provide the government with a cost-free alternative to advance JADO.

This SAJE testbed will support experiments in:

· Real-time Battle Management and Command (BMC2)

· ISR tasking

· Mission data processing at the edge (SmartSat)

· Direct downlink channel.

The SAJE testbed in orbit is just one example of how Lockheed Martin quickly provides new capabilities to its client. The digital twin test network with mobile ground service capabilities allows rapid prototyping before hardware or software is put into operation. Thanks to SmartSat, satellites can adapt to changing mission needs through a simple application.

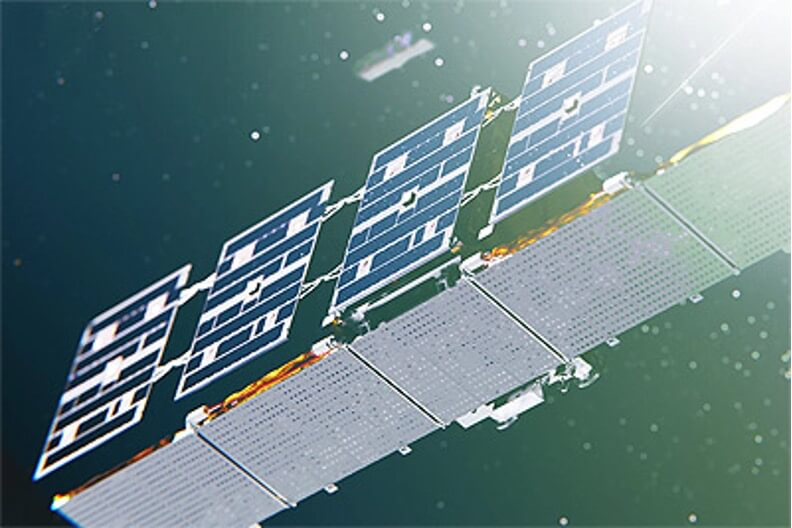

Two small Pony Express 2 satellites demonstrated a mesh network and tactical communication, as well as flexible Lockheed Martin SmartSatTM and HiveStarTM distributed application technologies. This mission combines four Lockheed Martin payloads on two small 12U Terran Orbital satellites, each the size of a shoebox. Pony Express 2 is part of Lockheed Martin's fast prototyping and technology certification mission in orbit. This is a continuation of the successful Pony Express 1 mission launched in 2019.

TacSat

Tactical ISR Sat ("TacSat") for hosting the first payload 5G.MIL

+ The third launched satellite - Tactical Satellite ("TacSat") - will demonstrate on-orbit processing, ISR detection, and communication capabilities.

+ TacSat will host Lockheed Martin's proven ISR sensor payload, allowing previously developed technologies to be used in space applications.

+ The mission will also host the first-ever 5G.MIL payload in orbit.

+ TacSat is based on the Space Development Agency's (SDA) Tranche 0 transport-level design, reducing risk for SDA in future tranches while providing flexibility to prototype new types of payloads.

+ The satellite is built on the Terran Orbital Zuma platform, the size of a mini-fridge.

Lockheed Martin's investments in the SAJE constellation are part of the company's commitment to advance the U.S. Department of Defense's vision for JADO. Without any cost to the government or diverting any existing space assets, SAJE is an innovative way to maximize ISR image transfer demonstration capabilities to U.S. Air Force fighters for target attack.

Acquisition of NRO ISR Satellites from Commercial Companies or Ready-made Images for NGA

In 2022, NRO/NGA took urgent steps to implement plans to acquire satellites (without waiting for the mass production of new satellites from the US MIC) and ISR images from commercial companies. This decision was largely influenced by the Russian Armed Forces' actions in Ukraine and the conclusions of US military officials presented to the US President in November 2022. Earlier (2019-2021), such plans had already been approved by the US Congress.

NRO Plans to Acquire Commercial Satellites for In-House Management

PredaSAR

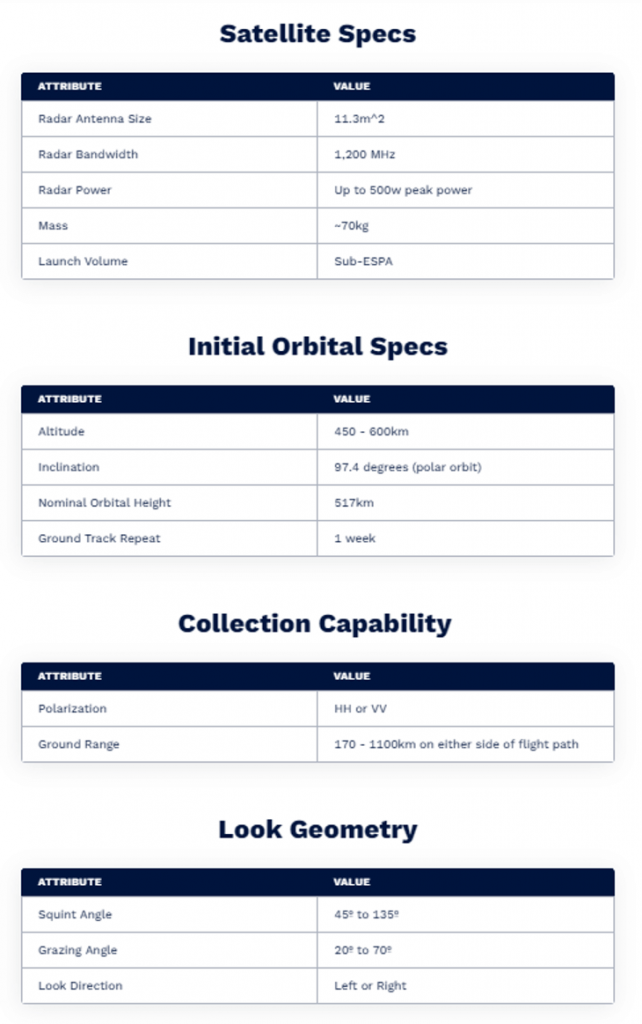

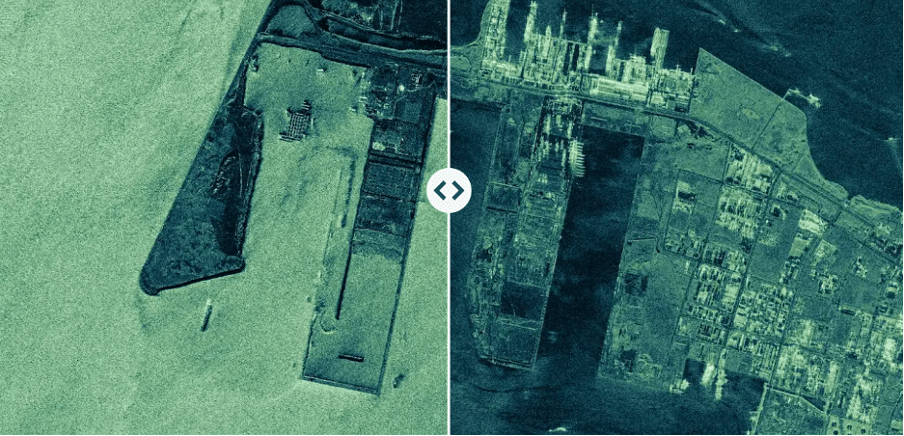

PredaSAR, a subsidiary of Terran Orbital, plans to create a modern constellation of SAR satellites, initially 48 and later increased to 96, to provide high-resolution SAR images for military use. The satellites will feature C-band SAR and X-band SAR radars.

PredaSAR satellites use advanced patented radar payloads to create 2D radar images with synthetic aperture, 3D reconstructions of objects and Earth's surface, as well as specialized information products. SAR satellites provide high-resolution images day and night and in any weather conditions, overcoming the natural limitations of traditional optical satellites.

Tyvak Nano-Satellite Systems Inc., another subsidiary of Terran Orbital, provides launch integration services in addition to being a satellite manufacturer.

These satellites are tactical, flexible micro-radar satellites with synthetic aperture radar (SAR). Their payload consists of a large C-band or powerful spot and an X-band strip system.

In April 2022, Terran Orbital doubled the size of the constellation to 96 satellites and planned to use some of them for commercial purposes. Later in the fall of 2022, they announced that the PredaSAR program was paused, and only two satellites would be launched as prototypes, with the overall PredaSAR constellation plan changing without specifying a new number of satellites or schedule. The US military is deciding whether to buy the entire future constellation or terminate or modify the contract. However, the first launch is already planned for 2023.

In the fall of 2022, Terran Orbital announced the abandonment of plans to create a constellation of 96 synthetic aperture radar satellites called PredaSAR, in order to focus on manufacturing satellites for US defense and national security customers. The company also formed a new division that will produce electro-optical satellites for image formation.

On December 22, 2022, Terran Orbital announced the completion of the delivery of 10 satellites ordered by Lockheed Martin for the Space Development Agency's mesh network in low Earth orbit. The company decided to manufacture radar, electro-optical, and communication (ISR geospatial information transfer) satellites exclusively for the US Department of Defense.

Umbra

The NRO chose Umbra as the first direction - commercial radar - within the framework of a new agency initiative for strategic commercial developments. Focused on commercial images and data, this initiative is specifically designed for the NRO to assess, utilize, and integrate new and emerging commercial phenomenologies, such as radar and radio frequency remote sensing.

"The support of US national security has always been the core mission of Umbra, and we are very pleased to be included in NRO's ongoing shift toward a hybrid payload architecture. We are deeply convinced that American companies in the commercial ISR sector will make a significant contribution to the prosperity of the United States," said Jason Mallare, Vice President of Government Programs. Umbra fulfills this mission by creating advanced hardware and software products for NGA analysts, addressing complex security issues for the United States and its allies. Umbra's satellites are equipped with a powerful synthetic aperture radar (SAR) capable of seeing at night and through dense clouds to create the highest-resolution radar images (15 cm) ever sold on the commercial market.

Terran Orbital

Corporation Terran Orbital completed a contract on January 09, 2023, with Lockheed Martin to provide commercial image transmission services. After processing, the company will present its considerations for the purchase of GEOStare SV2 NRO satellites or by the Space Force Command for tactical use. The main payload of GEOStare SV2 consists of two MonoTele telescopes developed by Lawrence Livermore National Laboratory and represents a dual-purpose system suitable for both Earth observation and space domain awareness (SDA). The goal of space domain awareness is to track satellites and debris in space to avoid collisions. Lawrence Livermore National Laboratory collaborates with Terran Orbital to partially meet the growing demand for commercial satellite images from the US Department of Defense. New methods for creating fast and accurate satellite images based on GEOStare satellites.

MonoTele is made from a single monolithic plate of fused quartz, optically shaped, and with reflective coatings on both ends. One MonoTele has a narrow field of view with high resolution for Earth observation, and the other has a medium field of view with high sensitivity for space domain awareness and astronomical applications. The compact payload is named GEOStare2 for optical imaging.

In addition to developing the payload for imaging and close collaboration with Terran Orbital on payload integration and nanosatellite, the Livermore team is responsible for analyzing images acquired in orbit.

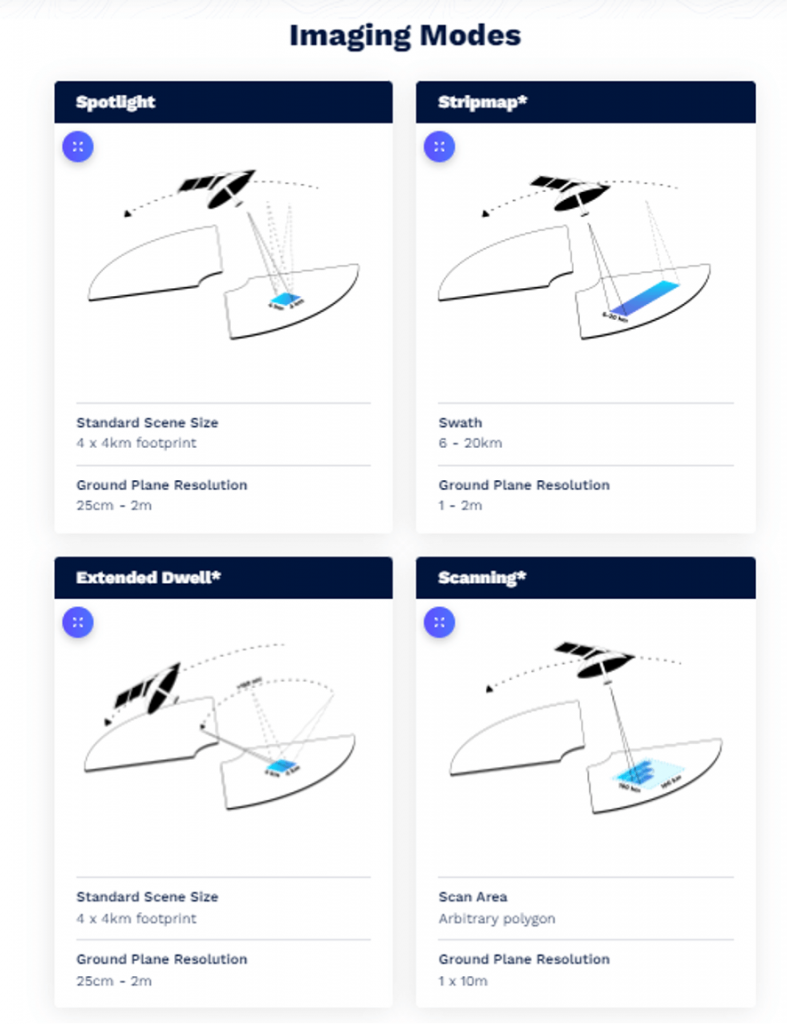

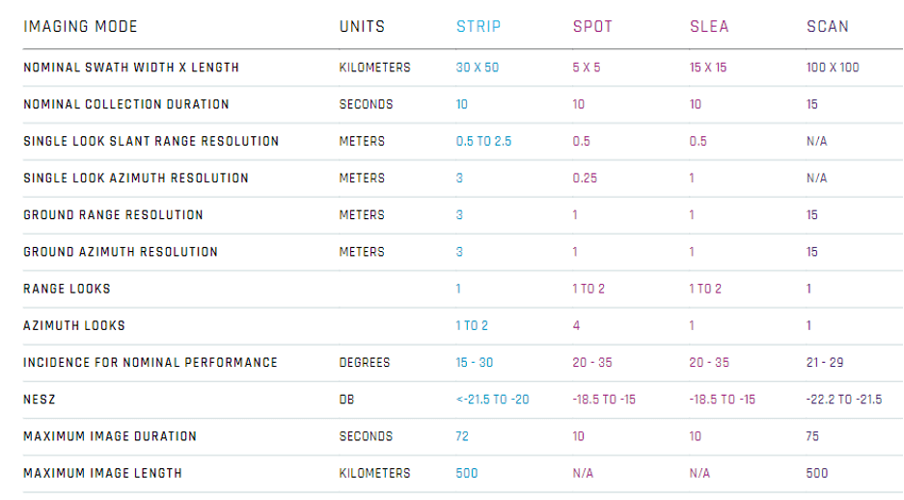

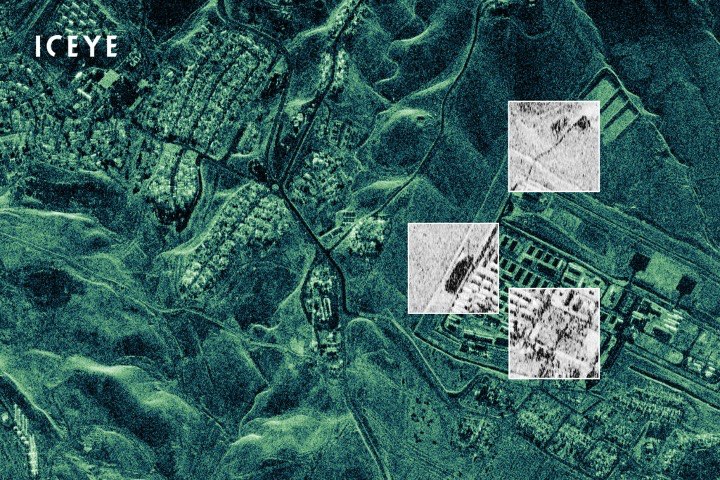

ICEYE X4 Satellite

ICEYE X4 and its successors are satellites from the microsatellite constellation equipped with X-band Synthetic Aperture Radar (SAR), developed by the Finnish startup ICEYE.

The Finnish startup ICEYE announced that it will provide images from one of its SAR (Synthetic Aperture Radar) satellites to the government of Ukraine, which is in a state of war, under a contract with the Ukrainian fund supporting the country's armed forces in the war with Russia.

"As part of the agreement, ICEYE will transfer all capabilities of one of its SAR satellites, already in orbit, for use by the government of Ukraine over the region," the company's statement from August 18, 2022 reads. "The SAR satellite will be operated by ICEYE. In addition, ICEYE will provide access to its SAR satellite constellation, allowing the Armed Forces of Ukraine to receive radar satellite images of critically important areas with high revisit frequency."

In addition, the company's US division is one of the five SAR satellite companies with contracts for research with NRO, valid until 2024, and plans to launch two ICEYE satellites in early 2023 and transfer them to NRO management. Satellites held by the US subsidiary have already been transferred to NRO.

ICEYE is designed to provide SAR images in near real-time. Iceye is working on launching and operating a constellation of microsatellites with its own compact and efficient SAR sensor technology. The ICEYE radar instrument can display images through clouds, overcoming weather and darkness.

ICEYE X10, X17, and X24 are built and owned by ICEYE US.

Several visualization modes provide unprecedented visibility and flexibility, allowing control over areas up to 50,000 km² in a single image and the ability to zoom into areas of interest with very high resolution to less than a meter—day or night, at any time, and under any weather conditions.

ICEYE satellite images provide reliable near-real-time data access anywhere on Earth. These data can be used to identify patterns of activity along borderlines and regions, expanding observation capabilities to ensure the security of any country. Images can be delivered on demand several times a day.

Spot Extended Dwell images illuminate the Earth for 25 seconds in one satellite pass. This allows capturing motion in the scene, which can be visualized through video.

New constellations will be launched as a set of four satellites, each capable of capturing images with a resolution of less than 0.7–1.0 meter.

ICEYE US, a subsidiary of ICEYE, announced receiving a contract from the National Reconnaissance Office (NRO). This contract allows ICEYE US to participate in the NRO's assessment of commercial remote sensing companies operating synthetic aperture radar (SAR) satellites and take over their management.

Contracts NRO for ISR Image Procurement

BlackSky, Maxar Technologies, and Planet

Contracts recently awarded by the National Reconnaissance Office (NRO) to BlackSky, Maxar Technologies, and Planet for commercial satellite images are likely to reshape the market, according to a new report from the research and consulting firm Quilty Analytics.

The Electro-Optical Commercial Layer (EOCL) contracts "confirmed Maxar's position as a primary government provider of very high-resolution images and highlighted the increased importance of small satellite constellations from Planet and BlackSky."

Maxar's contract is for five years with a base amount of 1.5 billion USD and options for an additional 1.74 billion USD in the second half of the contract. BlackSky's contract is for two years and is valued at 72 million USD with options up to 1 billion USD. Planet Labs has not disclosed the cost of its contracts yet.

The EOCL contract continues to use Maxar's outdated fleet of four satellites for image processing, so it remains at a level of 300 million USD per year for the first four years with the potential to increase to 340 million USD in the fifth year. The EOCL deal was long-awaited as Maxar was previously the sole provider of commercial satellite images to the NRO. While Maxar might lose a profitable monopoly, Wall Street analysts do not expect the new competition to harm the company since the overall addressable market for satellite images has grown.

The future Maxar WorldView Legion constellation, at least initially, does not fall under the EOCL contract. "This will allow Maxar to monetize 100% of this new capability with the NRO, other agencies, foreign governments, and commercial customers."

BlackSky's base contract met expectations overall, but the contract ceiling of around 1 billion USD over a 10-year period was significantly higher than analysts expected and "implies the potential for significant growth compared to the base contract."

Planet Labs - Planet announced an initial commitment of 146 million USD from the NRO for the first contract for five years of work with the SkySat satellite constellation, daily images from PlanetScope, and access to Planet's image archive. About half of Planet's revenue comes from commercial markets, and the other half comes from government markets. In the government business, roughly half is attributed to civilian agencies, and half to military and intelligence organizations. Planet Labs stated that its contract would provide the NRO with access to high and medium-resolution Planet satellite images. After reaching orbit and operational status, users will also have access to the next-generation Pelican fleet from Planet. The launch of Pelican satellites is expected to begin in early 2023 and will include the following features:

· Up to 32 new satellites to perform tasks that will complement and enhance the capabilities of the existing 21 SkySat satellites.

· Increased revisit speed, as customers are expected to receive images of the same location up to 12 times a day, and in mid-latitudes, there will be even 30 opportunities.

· Reduced data upload delays, allowing for shorter time cycles between data transmission and receipt worldwide.

· Higher resolution images with a resolution of up to 30 cm. The contract also provides access to Planet's archive, containing over 2000 images of each point on Earth since 2009.

Maxar remains the primary image provider for the U.S. government, but the company now needs to plan for long-term competition with BlackSky and Planet, both of which plan fleets of satellites with resolutions ranging from 30 to 50 cm, putting them in more direct competition with Maxar in a few years.

Quilty Analytics: The 10-year NRO deals "enhance the creditworthiness and investment attractiveness of all EOCL winners." The EnhancedView scheme is now replaced by the Electro-Optical Commercial Layer (EOCL) contract, shared among three providers.

Foreign operators, including those with subsidiaries in the U.S. like Airbus Defence and Space, ImageSat, Satellogic, and SI Imaging, have now been excluded, confirming the NRO's policy to buy electro-optical images only from U.S.-owned, -operated, and -registered companies. However, the agency stated that it plans to rely on non-U.S.-owned companies for radar images and possibly other services. This policy is confirmed by the work of these companies within NATO. Negotiations with Satellogic are ongoing for the purchase of data from thermal imagers in Ukraine, and NATO is counting on an optical constellation of 26 satellites with a resolution of 70 cm, which will increase to over 200 by 2025 with a resolution of 30 cm.

NRO Policy Regarding Commercial Satellite Companies

Under the EOCL, NRO will continue to procure various image products, including traditional images, as well as shortwave infrared, night, and hyperspectral images, along with direct communication with U.S. military remote ground terminals. Under this contract, NRO may also acquire "spot collection" services, where the government can task a commercial satellite to collect images over a specific location. Obtaining images of non-earthly objects in space is a new capability that NRO is acquiring, leveraging the sensors of commercial satellite space situational awareness.

As early as January 2022, NRO selected five commercial synthetic aperture radar (SAR) image providers for research contracts - Airbus, Capella Space, ICEYE, PredaSAR, and Umbra.

The goal is for the research contracts to inform NRO about available capabilities leading to long-term contracts.

Dealing with companies owning SAR satellites is more complex. NRO will currently work only with American foreign firms. The five agreements are signed for at least six months but can be extended up to 30 months. It was noted that two contracts - with Airbus and Iceye - were made with American subsidiaries of foreign companies, a first for NRO, which usually works only with local contractors. Under the research contracts, NRO will assess the SAR data of companies and cybersecurity capabilities. Capella Space operates a constellation of 6 satellites and is the first commercial SAR operator in the U.S. In 2019, the company signed an agreement with NRO to study the integration of SAR images into the agency's national ground architecture. The previous research contract was "largely focused on the architecture interface and actions necessary to integrate commercial radar products into it," while the new agreements are intended to assess the commercial radar capabilities of providers.

Airbus Defence and Space operates a constellation of three SAR satellites.

ICEYE U.S., a subsidiary of the Finnish SAR satellite operator, has the largest fleet of commercial SAR satellites, with 21 satellites launched to date.

PredaSAR, a startup owned by Terran Orbital, was rejected by NRO, and the company has completely shifted its focus to the optical segment.

Currently, Umbra has deployed 3 micro-SAR satellites.

Thus, as of now, NRO has signed 10-year contracts with three commercial optical image providers - BlackSky, Maxar, and Planet - but has not entered into similar contracts with other commercial providers, especially for SAR images.

NRO is attempting to create a hybrid environment of government and commercial remote sensing satellites in optical and radar bands. It is expected that contracts for SAR satellites will be signed in 2023, as the U.S. is not ready to provide sufficient military constellation capability.

As of January 2023, 23 companies worldwide have or plan to have SAR satellite constellations.

Conclusion

The National Reconnaissance Office (NRO) and the National Geospatial-Intelligence Agency (NGA) of the United States have actively developed military satellites (SATs) and technologies within the framework of the National Geospatial System for the past 15 years. The key element of this development is SATs that provide intelligence, surveillance, and reconnaissance (ISR) information from any point on Earth.

This information covers strategic and tactical levels of planned operations by the U.S. Armed Forces in theaters of military actions, primarily against Russia, Iran, and China.

As of 2022, the United States Space Command takes on the management and development of tactical-level reconnaissance with SATs, according to the decision of the U.S. Department of Defense.

The value of the space component of reconnaissance was particularly evident in providing reconnaissance information and preparing its use by the Armed Forces of Ukraine during Russia's Special Military Operation.

Lessons and shortcomings of such assistance were analyzed in November 2022 at a meeting of the Joint Chiefs of Staff of the U.S. Armed Forces.

An analysis of the system, composition, technical characteristics, and prospects for the development of the U.S. military space component showed that as of 2022, the U.S. Armed Forces have not yet fully addressed the tasks (due by 2025) of creating a unified ISR intelligence, regardless of the sensor equipment of geospatial reconnaissance in space, aviation, UAVs, and in field combat conditions, according to the target setting: from imaging the enemy target, its automatic georeferencing to its high-precision destruction within the compressed time frames of modern warfare.

The solution to such a task is in progress. The ISR orbital grouping in space is clearly insufficient, and the commercial factor has to be involved. For example, the space information for the Armed Forces of Ukraine was obtained from 12 military SATs of the U.S. and NATO, while commercial companies sold such information from 30 of their SATs. It is indicative that today, the NRO buys up to 70% of images from leading global commercial firms, many of which improve their financial affairs at the expense of the U.S. military. In fact, many commercial companies have become an affiliated product of the U.S. military. However, this is a business question. In addition, in 2022, the NRO began leasing the best SATs from commercial companies.

It is essential to understand that military developments are implemented in the civilian sector (geospatial reconnaissance is indeed the engine of modern digital analysis and solutions), and budgetary expenditures are returned through the rapidly developing global civilian remote sensing market.

Military and civilian geospatial products are practically identical in essence: analytical solutions, 3D modeling, detailed images, spectral (hyperspectral) solutions, automatic processes, image compression, online transmission to the consumer, etc.

Analytics on countries will be presented in the following reviews (2023Q1-Q2):

o NATO (United Kingdom, Germany, France, Spain, Italy, Turkey)

o China

o India

o Israel

o Japan

o South Korea

o Luxembourg